Disney Stock Price Prediction 2025: The Walt Disney Company is a media conglomerate that owns many well-known brands, such as Disney, Marvel, Pixar, and Star Wars. It is one of the most-traded stocks on the New York Stock Exchange (NYSE), and long-term investors like to buy it. This article will go over the history of Disney’s stock price and look at the things that will affect the value of its shares in 2025.

Contents

Disney’s Stock Price History

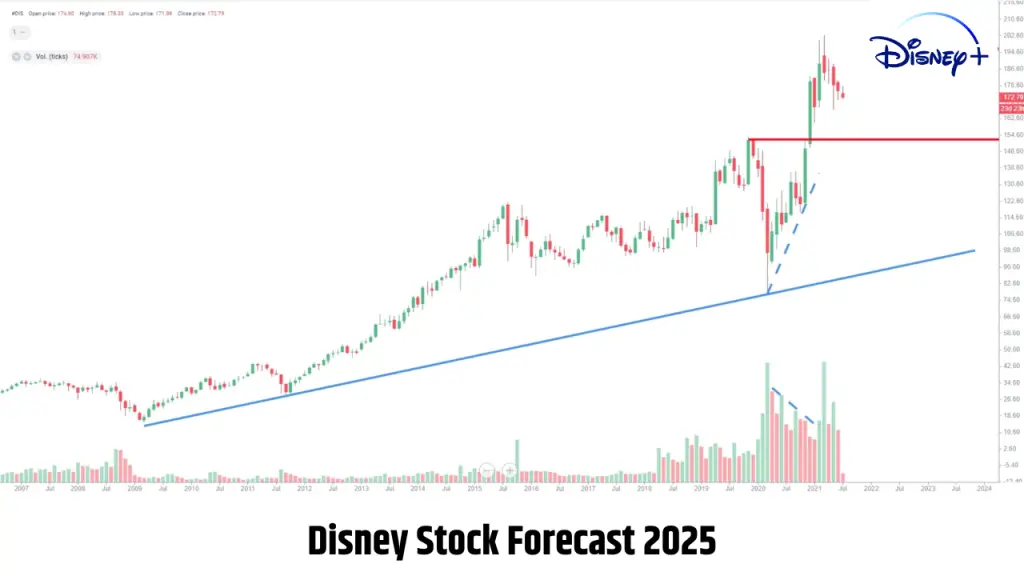

To figure out what Disney’s stock price will be in the future, we need to look at how it has done in the past. In the last ten years, Disney’s stock has been going up. Its share price went from $34 in 2012 to $195 in 2021, which shows that the stock has been going up.

The stock value of the company reached its highest point of $203 in December 2019 but dropped to $85 in March 2020 because of the effects of the COVID-19 pandemic on the company’s theme parks and movie releases. But the price of the stock has gone back up, and as of March 2023, it is worth $175.

Factors Affecting Disney’s Stock Price In 2025

In the coming years, the price of Disney stock will be affected by several things. Let’s examine each of them more closely.

1. Streaming Services

The Disney+ streaming service came out in November 2019 and has been a huge hit. It has more than 280 million subscribers around the world as of March 2023, which is more than its original goal of 60–90 million subscribers by 2024.

Disney has been able to get back on its feet after the pandemic hurt its theme parks and movie releases. In 2025, Disney+ will still bring in a lot of money and make the company a lot of money. If Disney+ keeps growing at the rate it is now, it could have 500 million subscribers by 2025. This would be good for the stock price of the company.

Also read: GESI Stock Price Prediction 2023, 2024, 2025, 2026, 2027, 2028

2. Theme Parks

The COVID-19 pandemic had a big effect on Disney’s theme parks, which led to a drop in the company’s revenue and stock price in 2020. But as vaccines become more widely available, people are likely to visit theme parks more, which will be good for Disney’s stock price in 2025.

Also, the company is planning some new attractions for its theme parks, such as the Avengers Campus at Disneyland Resort and the Star Wars: Galactic Starcruiser at Walt Disney World Resort, which could bring in more visitors and make the company more money.

3. Movie Releases

Disney is a big name in the movie business. It has many successful movie series, such as Marvel and Star Wars. The pandemic has messed up the movie business, causing movie releases to be pushed back and less money to be made at the box office.

But when theatres reopen and people go to the movies again, Disney’s new movies could bring in money and boost the stock price of the company in 2025. Also, Disney has a lot of movies coming out in 2025 that people are looking forward to, like Avatar 5 and Star Wars: Rogue Squadron.

Also read: Adani Wilmar Stock Price Prediction

4. Competition

Other media companies, like Netflix, Amazon, and Apple, give Disney a lot of competition. These companies offer streaming services and make content that competes with what Disney has to offer.

If Disney loses subscribers to these other services because of the competition in 2025, this could hurt the price of its stock. But Disney has a strong brand and a large group of loyal fans, which could help it keep its subscribers.

5. Economic Factors

Lastly, things like inflation, interest rates, and the state of the world economy could affect the price of Disney stock in 2025. A recession or economic downturn could make people spend less, which would mean less money for Disney.

Disney, on the other hand, has a business model with many different ways to make money, which helps protect it from changes in the economy. The company also has a strong balance sheet and cash reserves, which could help it get through any bad times in the economy.

Also read: Meta Platforms Stock Price Prediction

Disney Stock Price Prediction For 2025

Based on the things we’ve talked about so far, it’s hard to say for sure what Disney’s stock price will be in 2025. But a lot of analysts are hopeful about the company’s future. Analysts at J.P. Morgan, for example, think that Disney’s stock price could reach $220 by the end of 2025, thanks to the success of Disney+.

In the same way, analysts at Goldman Sachs think that Disney’s stock price could reach $231 by 2025. They base this on the company’s diverse business model and a strong portfolio of intellectual property.

Predictions about stock prices aren’t always right, so you should take them with a grain of salt. Many things outside of Disney, like unplanned events or changes in the market, could affect the price of its stock in ways that are hard to predict.

Also read: Tesla Stock Prediction 2030

Disney Stock Price Prediction 2025: Frequently Asked Questions

Q1. What is Disney’s stock price right now?

Ans. As of March 2023, a share of Disney is worth $175.

Q2. How has the COVID-19 pandemic changed the price of Disney’s stock?

Ans. In 2020, Disney’s stock price went down because of the effects of the pandemic on the company’s theme parks and new movies. But the stock price of the company has gotten better since then.

Q3. What is causing Disney+ to grow?

Ans. The popularity of Disney’s intellectual property, like the Marvel and Star Wars franchises, is helping Disney+ grow.

Q4. What new attractions are coming to Disney’s theme parks?

Ans. Disney is planning to add new things to its theme parks, like the Avengers Campus at Disneyland Resort and the Star Wars: Galactic Starcruiser at Walt Disney World Resort.

Q5. Is investing in Disney stock a good idea for the long term?

Ans. Many analysts are optimistic about Disney’s future and think that its strong brand and diverse business model make it a good choice for long-term investors. But people who want to buy stocks should do their research and think about their own financial goals before doing so.

Conclusion

Disney is a large media company that owns many well-known brands, such as Disney, Marvel, and Star Wars. The stock price of the company has been going up over the last ten years, and its share value in 2025 will depend on several things. These factors include the growth of Disney+, the number of people going to theme parks, the release of new movies, competition, and the economy.

Even though it’s hard to say for sure what Disney stock price prediction for 2025 will be, many analysts are optimistic about the company’s future. Overall, Disney is a good choice for long-term investors because it has a strong brand and a diverse business model.