Are you looking for the best Dwac Stock Price Prediction? Read to know more. There has been a lot of buzzes lately about Digital World Acquisition Corporation’s (DWAC) stock. The future direction of the stock market is notoriously difficult to predict. However, that hasn’t stopped investors from trying to divine the next big winner.

When it comes to Dwac stock, there is no shortage of opinions. Some people are bullish on the company’s prospects, citing its strong track record of delivering shareholder value. Others are more cautious, noting that Dwac stock is already trading at a premium to its peers. So, what’s the verdict on Dwac Stock Price Prediction?

The current worth of Dwac stock is 18.03 USD. The long-term investors are optimistic about the company’s future prospects and predict that the price will reach 58.68 USD in 2025.

With a lot of people investing in it, the price of this stock is going to go up astronomically. Their stock price has been steadily increasing over the past few years.

Despite the recent volatility in the market, analysts believe that Dwac is well-positioned to continue its growth in the coming years. In fact, many experts are predicting that the stock will reach new highs by 2022.

Here, we’ll take a closer look at Dwac Stock Price Prediction and whether or not you should invest in it.

Contents

About Digital World Acquisition Corporation (DWAC)

Digital World Acquisition Corporation is a blank check company formed for the purpose of acquiring, through a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or other similar business combination, one or more businesses in the digital world.

Dwac was incorporated in December 2020 with its headquarters in California, United States. Patrick Francis Orlando is the CEO of Dwac.

Despite the ever-changing digital landscape, there are still many opportunities for businesses to grow and thrive in this space. The management team has significant experience in both the digital world and in executing transactions and believes they are uniquely positioned to take advantage of these opportunities.

They are focused on businesses that have the potential to generate long-term value for their shareholders and will continue to look for ways to create shareholder value through opportunistic acquisitions and investments.

DWAC – Performance Overview

| Market Cap | 670.981M |

| Enterprise Value | 674.44M |

| Shares Outstanding | 30.03M |

| Public Float | 30.03M |

| 52 Week Range | 14.80 – 101.87 |

| 200-Day Moving Average | 28.94 |

| EPS (TTM) | -0.14 |

| Fwd P/E (NTM) | – |

| Trailing P/E | N/A |

| Forward P/E | N/A |

| EBITDA | N/A |

| Revenue (ttm) | N/A |

Profitability

| Profit Margin | 0.00% |

| Operating Margin (ttm) | 0.00% |

Cash Flow Statement

| Operating Cash Flow (ttm) | -2.08M |

| Levered Free Cash Flow (ttm) | N/A |

| Class | Number Of Shares |

| Existing TMTG Shareholders | 87.5M |

| DWAC Shareholders | 28.75M |

| Sponsor Shares | 7.9M |

| PIPE | 29.77M |

| Earnout Shares | 40.0M |

| Warrants | 15.7M |

| Convertible Notes | 3.16M |

| Total | 212.8M |

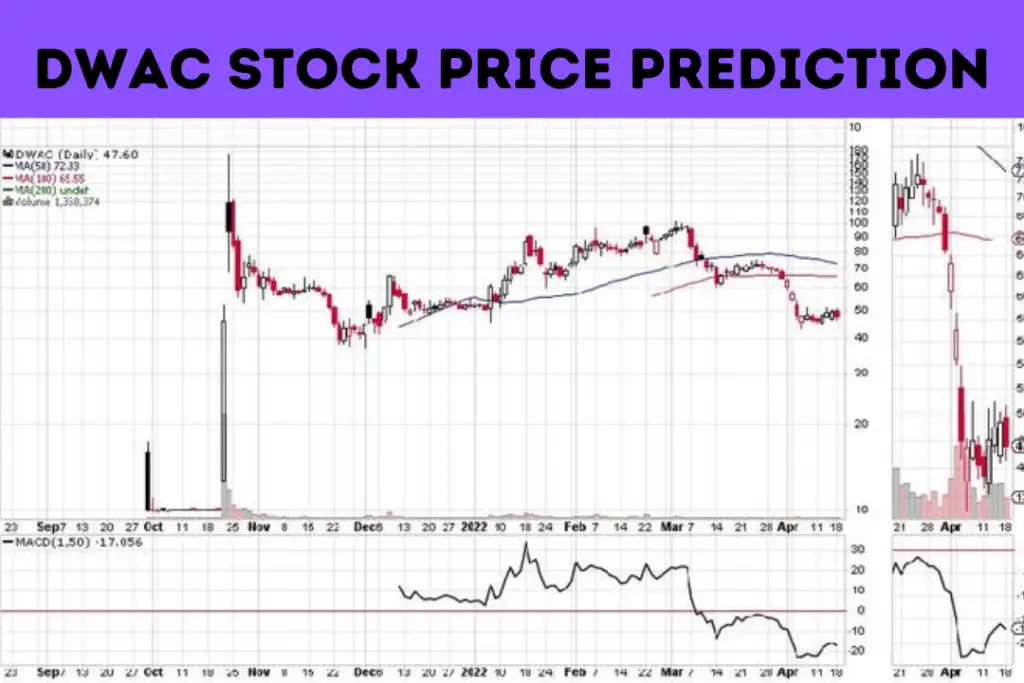

DWAC Stock Price Forecast For 2023, 2024, 2025, And 2026

DWAC Stock Price Prediction 2023

The weighted average target price per share of Dwac is expected to rise sharply reaching 27.73 USD by the end of 2023. The expected price targets are to be 23.74 USD on the lower end and 34.22 USD per share on the higher end with expected price volatility of 30.632%.

DWAC Stock Price Prediction 2024

The weighted average stock price of Dwac is expected at 31.08 USD per share at the end of 2024. Further, an optimistic trend is expected to prevail with the lowest price estimate at 27.54 USD and the highest target estimate being 36.21 USD. The monthly expected price volatility is to be 23.948%.

DWAC Stock Price Prediction 2025

The weighted average predicted stock price per share of Digital World Acquisition share in 2025 is expected to show an upward trend reaching 58.68 USD at the end of the year, with possible monthly volatility of up to 24.522% expected throughout the year. The lowest target price is estimated at 50.94 USD while the highest is 67.48 USD.

DWAC Stock Price Prediction 2026

The per share price of Dwac is to show a negative trend in January 2026 when the average share price is expected to fall to 54.46 USD.

The share prices will show a positive dynamic towards the end of the year 2026 when the average expected price per share will reach as much as 106.09 USD. The price targets on the lower end will be 83.17 USD and on the higher end will be 113.73 USD. Monthly price volatility of 26.866% is anticipated.

Digital World Stock Price Prediction (DWAC) Analysis

Why is the price of Digital World so high? It is happening because institutional investors are trading it back and forth among themselves. When news about a particular company is released, it can affect its stock prices even if there’s no indication of what will happen with profits in the future.

Hype to individual companies often acts as price momentum. If there is no expected positive publicity, the stock prices tend to fall.

Speculative stocks are often more volatile than established companies, but it’s essential to pay attention when there’s news about a new company that could be worth investing in.

The key here is not to get caught up in the hype. If you see this happening with Digital World, there might be something going on and it could present an excellent short-sale opportunity for investors who are aware enough of what they’re doing.

Also read stock predictions of:

- Rivian Stock Price Prediction 2025 | What Do The Analysts Say?

- Warner Bros Discovery Stock Price Prediction 2023 – 2026

- Square Stock Price Prediction 2023 – 2026

Is DWAC Stock A Buy, Sell, or Hold?

When it comes to investing in stocks, there are three main options: buy, sell, or hold. For the most part, investors will want to buy stocks that are undervalued and have the potential to go up in price.

They will also want to sell stocks that are overvalued and may be at risk of going down in price. Finally, investors may choose to hold onto a stock if they believe it is fairly valued and has a good chance of remaining stable. With this in mind, let’s take a look at Dwac stock.

Based on recent market trends, it appears that Dwac stock is currently undervalued and has the potential to rise in price. As such, it may be a good idea to buy Dwac stock at its current price.

But it is to bear in mind that these are predictions for the long term only; investors should beware of possible risks of investing in this stock in the short term.

However, this is not financial advice, and any decisions made regarding Dwac stock should be made after careful consideration and research.

Final Words

Dwac stock is on the rise and is predicted to continue increasing in price. If you are looking for a long-term investment, now may be the time to invest in Dwac stocks. The future looks bright for this company, and its innovative products and services are sure to keep them at the top of its industry.

Thanks for following our analysis of Dwac stock!