In this blog post, we’ll take a look at NU Holdings stock price prediction and what factors could influence its stock price in the months ahead. By understanding these factors, you may be able to make more informed investment decisions when it comes to NU Holdings stock. Stay tuned!

It’s no secret that the stock market is a volatile place. No one can predict where the markets will go on any given day. However, there are some techniques investors can use to make informed guesses about where a stock might be headed in the future.

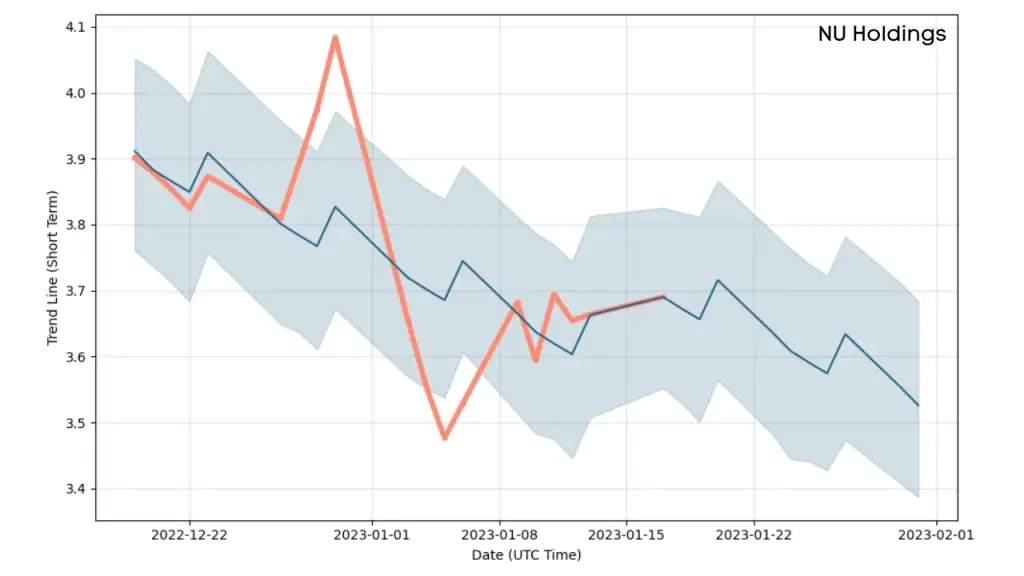

The current stock price of NU holdings is 3.67 USD. The prediction for short-term shows bearish trends with average prices reaching 3.02 USD in 2023. The weighted average prices are expected to be 2.33 USD in 2026.

Contents

Nubank (NU Holdings)

Nubank is a neobank or digital-only bank, that was first launched in Brazil on 6 May 2013. Unlike traditional brick-and-mortar banks that rely heavily on physical branches and staff, neobanks like Nubank focus primarily on providing digital financial services through online platforms without any physical offices.

It was founded by Colombian David Vélez, Brazilian Cristina Junqueira, and American Edward Wible. Its first Nubank card transaction was made on April 1, 2014, and then became a unicorn startup 4 years later with a valuation of 1 billion USD.

This streamlined approach allows it to operate with lower overhead costs, which they then pass along to its customers in the form of lower fees and interest rates.

Additionally, it offers more flexible solutions than traditional banks can provide, such as automated systems for credit scoring and delinquency detection. Overall, Nubank has quickly become one of the most successful financial service organizations in the world thanks to its innovative approach and focus on customer satisfaction.

NU Holdings – Financial Information

| Market Cap | 17.196B |

| Enterprise Value | N/A |

| Shares Outstanding | 3.57B |

| Revenue (TTM) | 1.47B |

| 52 Week High | 3.2600 |

| 52 Week Low | 11.8300 |

| Volume | 27,034,641 |

| Avg. Volume | 27,355,868 |

| Diluted EPS (TTM) | -0.0660 |

| P/E (TTM) | -108.47 |

| Forward P/E | 39.37 |

| EBITDA (TTM) | N/A |

| Website | www.nubank.com.br |

Profitability

| Profit Margin | -9.05% |

| Operating Margin (ttm) | -11.94% |

Cash Flow Statement

| Operating Cash Flow (ttm) | -1.33B |

| Levered Free Cash Flow (ttm) | N/A |

NU Holdings Stock Forecasts For 2023, 2024, 2025, And 2026

NU Holdings Stock Price Prediction 2023

The current stock price of NU Holdings is 3.67 USD. The prices at the end of the year will be 3.02 USD with the lowest target price to be 2.80 USD and the highest to be 3.25 USD. Price volatility of 13.915% is expected.

NU Holdings Stock Price Prediction 2024

In 2024, the weighted average stock prices are expected to be 2.59 USD, with expected volatility at 18.441% at the beginning of the year. The year ends with positive dynamics with stock prices being 2.19 USD. The lowest expected price target is $2.06 and the highest is $2.33. Positive dynamics are expected to prevail with probable price volatility of 11.278%.

NU Holdings Stock Price Prediction 2025

The weighted average price target is expected to fall to 1.59 USD at the end of the year 2025, with the lowest range of $1.44 and the highest range being $1.82. Price volatility of 20.906% is expected and positive dynamics are expected to prevail in this period.

NU Holdings Stock Price Prediction 2026

The weighted average target price per share of Nu Holdings in Jan 2026 is expected to be $1.68, with possible monthly possible volatility of 12.237%. At the end of the year, average prices are expected to hit 2.14 USD with monthly expected volatility of 13.093%. The lowest expected range is 2.14 USD and the highest range is 2.46 USD.

Is NU Holdings Stock A Good Buy?

According to the consensus report of 13 analysts offering ratings of NU Holdings stock, 8 analysts have given it a Strong Buy rating, 1 analyst has given a Buy rating, 3 analysts with a Hold rating, and 1 analyst giving a Sell rating.

Therefore, it is evident that the analysts in the majority are expecting the stock prices to be profitable in the long run, showing growth in terms of revenue and profitability.

Analysts have forecasted these bullish forecasts due to various reasons. Firstly, veteran investors know that Warren Buffett-owned stocks are always expected to be on the rise in the future and investors follow his moves to get predictions on stock prices.

His recent purchase is stocks of NU Holdings which has investors giving preference to this stock. This purchase decision is because NU holdings’ stocks are a new way of banking that has seen positive responses since its inception.

Additionally, the company reported impressive revenue growth of triple digits in the first quarter, adding millions more customers to its already substantial base. The share price has fallen, but even after this year’s decline, it is still lofty.

Although the market isn’t happy with NU stocks lately, NU has been making tremendous progress with regard to its growth potential, and it may be time for investors who are willing to take some risk in order to get on board this emerging industry. So, hopefully, the NU Holdings Stock Price Prediction will be in favor.

The shares have bottomed out at an all-time low which provides you the opportunity that there will soon begin another round of upgrading from Wall Street as they recognize just how big of a deal nu really is!

Also Check:

- DWAC Stock Price Prediction 2023, 2024, 2025, 2026

- Square Stock Price Prediction 2023 – 2026

- Warner Bros Discovery Stock Price Prediction 2023 – 2026

NU Holdings Stock Price Prediction – Commonly Asked Questions

Q1: Can I Buy NU Holdings Ltd Shares In India?

A1: Yes, you can buy NU Holdings shares in India by opening an international trading account with a reputed exchange.

Q2: Who Invested In Nubank?

A2: The Nubank team is proud to have investors including Ischyros New York and Morgan Stanley. These two prestigious firms provide their financial support, which will allow the company to grow fast in the future.

Q3: How Much Funding Has Nubank Raised To Date?

A3: Nubank (NU Holdings) has raised $3.9B USD of funding to date.

Q4: Who Are Nubank’s Competitors?

A4: There are many banks in this country that could potentially become Nubank’s competitors. These include Raiffeisen Bank, C6 bank, and Banco Inter among others.

Q5: What Documents Are Required To Invest In Nu Holdings Ltd Nubank Stocks?

A5: To invest in Nu Holdings Ltd Nubank (NU), you will need proof of identification and residence. For identification, Aadhaar, PAN, Passport, etc. are required and for residential proof, Aadhaar, Voter Card, etc. are required.

Final Take

In the past few years, NU Holdings has experienced tremendous growth in both profits and stock prices. Analysts have predicted that this trend will continue well into the future, with the company’s stock rising at a rapid rate over the next 5-10 years.

Some economists have even gone so far as to predict that NU Holdings’ profits could double within the next decade, putting it in an excellent position for continued success and market dominance.

While some skeptics still doubt that such growth can be sustained, there is no denying that NU Holdings has proven itself to be one of the most promising and profitable firms on the stock market today.

Whether you are an investor looking for lucrative returns or simply a casual observer interested in following one of today’s leading corporate success stories, NU Holdings remains an essential part of any portfolio or investment strategy.