In this blog post, we will discuss the Robinhood stock price prediction for upcoming years. We will also provide our readers with information on what Robinhood is and how it is currently performing in the market.

It is no secret that the stock market can be a risky place. For those who are not familiar with the stock market, it may seem like a good idea to invest in a company’s stock. However, some people may not realize that investing in stocks can be a very risky move.

The current stock price of Robinhood is 9.32 USD. Analysts are predicting that the price per share will be $5.79 in 2025. If the conditions improve for the company, the average stock prices are expected to rise to 7.56 USD in 2026.

The company recently announced that it will offer cash management accounts, which will give users the ability to earn interest on their uninvested cash. This move is likely to attract more customers to the platform and could lead to an increase in Robinhood’s stock price.

In addition, Robinhood has been aggressively expanding its business by launching new products and services. The company is thus expected to continue to grow at a rapid pace in the future and this is likely to drive up the stock prices even further.

Contents

About Robinhood Markets & Its Performance

Robinhood Markets is a financial services platform that allows users to invest in stocks, ETFs, and options. The company is headquartered in Menlo Park, California, United States, and was founded in 2013 by Vlad Tenev and Baiju Bhatt.

Robinhood also offers a cash management account that allows customers to earn interest on their deposited funds. In addition, Robinhood provides a mobile app that allows customers to track their investment portfolios, place trades, and view real-time market data. The app is available for iOS and Android devices.

Robinhood Markets has been incredibly successful and has raised over $1 billion from investors such as Andreessen Horowitz, Sequoia Capital, and DST Global.

The platform has been praised for its user-friendly interface and commission-free trading. It has also introduced a number of features such as instant deposits and Robinhood Gold.

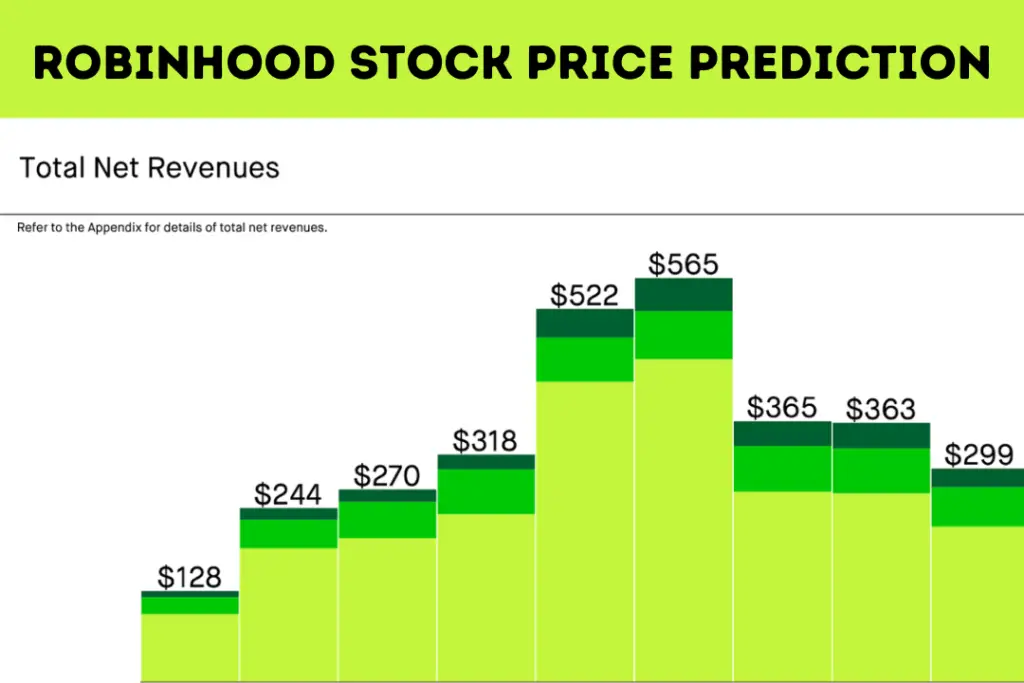

Robinhood – Performance Overview

| Market Cap | 7.788B |

| Enterprise Value | 3.49B |

| Revenue (ttm) | 1.34B |

| EBITDA | N/A |

| Shares Outstanding | 835.68M |

| Public Float | 512.52M |

| EPS (ttm) | -4.04 |

| PE Ratio | N/A |

| Forward PE | N/A |

| Dividend | N/A |

| Ex-Dividend Date | N/A |

| Volume | 10,717,578 |

| Avg. Volume | 10,178,944 |

| 52-Week Range | 6.81 – 16.49 |

| 200-Day Moving Average | 9.71 |

| Analysts | Hold |

TTM – Trailing Twelve Month

Profitability

| Profit Margin | -95.77% |

| Operating Margin (ttm) | -94.62% |

Management Effectiveness

| Return on Assets (ttm) | -5.85% |

| Return on Equity (ttm) | -17.92% |

Cash Flow Statement

| Operating Cash Flow (ttm) | -1.31B |

| Levered Free Cash Flow (ttm) | N/A |

Ratios

| PE Ratio | – |

| PS Ratio | 6.69 |

| PB Ratio | 1.28 |

| EV/Sales Ratio | 2.32 |

| Debt / Equity Ratio | 0.02 |

| Debt / EBITDA Ratio | -0.06 |

| Debt / FCF Ratio | -0.07 |

| Current Ratio | 1.38 |

| Asset Turnover | 0.07 |

| Return on Equity (ROE) | -33.70% |

| Return on Assets (ROA) | -11.80% |

| Return on Capital (ROIC) | – |

| Earnings Yield | -27.00% |

| FCF Yield | -24.50% |

| Buyback Yield / Dilution | -276.74% |

| Total Shareholder Return | -276.74% |

EBITDA – Earnings before interest, taxes, depreciation, and amortization

Cryptocurrency Trading

Robinhood is known for being more affordable than other financial institutions, but it just announced that it will be adding cryptocurrency trading to its platform. The waitlist was over 1 million people long within days.

Now users can trade Bitcoin and Ethereum in California with no fee or commissions at all until stocks start rolling out nationwide later this year. In May 2018, Robinhood announced that they were expanding its trading platform to Wisconsin and New Mexico.

Robinhood began expanding its offerings in September of 2021 by adding trading for Bitcoin Cash, Dogecoin, Ethereum Classic, and Litecoin.

They also launched a waitlist for cryptocurrency wallets that would allow users to sign up automatically at certain times when investing was open which is usually every day but can vary depending on demand.

Robinhood (HOOD) Stock Price Forecasts For 2023, 2024, 2025, And 2026

Robinhood Stock Price Prediction 2023

An upsurge is expected in the average share prices at the beginning of 2023 when they are expected to reach 10.16 USD. Going through some positive and negative trends throughout the year, the average price per share is expected to be 8.11 USD in December 2023. The lowest price target is expected to be 7.54 USD and the highest price is to be 8.53 USD with 11.713% monthly volatility.

Robinhood Stock Price Prediction 2024

The average forecasted share price per share of Robinhood will be 7.21 USD at the start of the year 2024 as per the analysts. At the end of the year, the average share price targets are expected to be 6.23 USD. Negative dynamics are expected to prevail and a monthly volatility of 17.701% is expected.

Robinhood Stock Price Prediction 2025

Stock predictions show positive dynamics at the beginning of 2025 with average prices at 6.73 USD. The average price per share at the end of the year would fall to 5.79 USD. Positive dynamics are expected to prevail in this period with monthly expected volatility being 10.730%.

Robinhood Stock Price Prediction 2026

In 2026, average share prices are expected to reach 7.56 USD in December 2026 following some ups and downs throughout the year. The lowest target is to be 6.80 USD and the highest will be 8.35 USD. Monthly expected volatility is anticipated to be 18.521%.

Also read the following stock forecasts as well:

- Rivian Stock Price Prediction 2025 | What Do The Analysts Say?

- Volta Stock Price Prediction, VLTA Forecast & Price Targets

- Plug Power Stock Price Prediction 2023, 2024, 2025, 2030, 2040

Robinhood Stock Price Prediction: Frequently Asked Questions

Q: Is Robinhood Stock A Good Investment?

A: There’s no question that Robinhood has been one of the hottest stocks on the market over the past year. The online broker has seen its fair share of ups and downs, but overall, the trend has been upwards.

Robinhood’s stock price has been on the rise in recent years, indicating that investors are confident in the company’s future prospects. Taken together, these factors suggest that Robinhood stock is a good investment.

It is, however, important to do your research before putting any money into the stock.

Q: What Is Robinhood’s Average 12-month Price Target, According To Analysts?

A: Robinhood’s 12-month average price target is $11.25, which represents an increase over their current share prices.

Q: What Is Robinhood Markets’ Price Target?

A: Robinhood’s price target is $11.25, which has been given by 10 Wall Street analysts in the last 3 months. The highest analyst forecast for this stock stands at 28 dollars and the lowest estimate includes an unlikely scenario where someone would be willing to pay just 7 dollars for it.

Q: Should I Buy Or Sell Robinhood Markets Stock Right Now?

A: According to 13 Wall Street research analysts, the ratings are 4 sell ratings, 4 hold ratings and 5 buy ratings for the Robinhood stock.

Q: What Is Robinhood Markets’ Stock Symbol?

A: Robinhood market’s stock symbol is “ HOOD” through which it trades on NASDAQ.

Final Take

A stock price prediction is a calculation of the future value of a security, based on current market conditions and expectations. This approach looks at historical data to discern patterns that can help predict future movements in a security’s price.

In order to make an accurate Robinhood stock price prediction, it’s important to consider all aspects of the business, both past, and present. Although the stock price is showing negative trends, these stocks are worth watching as they are trending stocks with growth potential.

However, always do your analysis before investing in any stock. Visit back for more updates on share prices and stocks.