One of the most recognizable names in the world when it comes to luxury automobiles is Rolls Royce. And while the company has faced some financial challenges in recent years, there’s no doubt that Rolls-Royce is still a powerhouse in the automotive industry.

People are highly curious to know the future prediction for Rolls Royce RR stocks so as to make stock purchase or sell decisions. So what does the future hold for RYCEY stocks? In this Rolls Royce Stock Prediction blog, we will analyze RR stocks and offer our opinion on where we see RR’s stock heading.

Currently, Rolls Royce is trading at 1.36 USD per share. The prices per share are expected to rise to an average target of 6.20 USD in 2025 with the highest price target being 6.30 USD.

Contents

All About Rolls-Royce Limited

Established in 1904 by the collaboration of Charles Rolls and Henry Royce, Rolls-Royce Limited was a British manufacturer of luxury automobiles and later, aircraft engines.

Building on Royce’s reputation established with his Ohydrogen car, which he had produced since 1901, Rolls-Royce won a contract to supply engines for aircraft of the newly formed Royal Flying Corps in 1912.

The company moved its operations to Derby in 1908. After taking over C.S. Rolls & Co. Limited and building a new factory, it began to manufacture aero engines under its own name in 1914.

Today, Rolls-Royce is owned by BMW and continues to produce some of the world’s finest luxury cars. The company still produces a wide range of engines for both civil and military aviation.

Rolls-Royce Holding PLC – Financial Information

| Market Cap | 11.785B |

| Shares outstanding | 17.52B |

| Free float | 8.23B |

| Volume | 4,064,055 |

| Avg. Volume | 3,090,927 |

| 52-Week Range | 0.7100 – 1.6700 |

| PE Ratio (TTM) | 68.00 |

| EPS (TTM) | 0.0200 |

| Forward Dividend & Yield | N/A |

Profitability

| Profit Margin | -15.67% |

| Operating Margin (ttm) | 5.53% |

Cash Flow Statement

| Operating Cash Flow (ttm) | 1.02B |

| Levered Free Cash Flow (ttm) | 590.63M |

Market Capital Change Over Previous Years

| Year | Market cap | Change |

| 2022 | $8.87 B | -35.35% |

| 2021 | $13.87 B | 9.38% |

| 2020 | $12.68 B | -26.65% |

| 2019 | $17.29 B | -13.38% |

| 2018 | $19.97 B | -4.68% |

| 2017 | $20.95 B | 38.83% |

Are RYCEY Stocks A Buy, Sell, Or Hold?

Are RYCEY stocks a buy, sell, or hold? According to consensus ratings given by the analysts, the answer is Hold. While there have been a few analysts who have given Sell ratings during previous months, they are now shifting to giving Buy ratings to this stock.

This means that most analysts think that the stock is fairly valued and recommend neither buying nor selling, that is, maintaining their current position without buying new RYCEY stocks or selling previous ones.

This shift in ratings of analysts indicates that they are optimistic about the future of Rolls-Royce Limited. The growth trends are exhibiting interesting patterns which have pushed analysts to be in favor of Rolls Royce RR stocks.

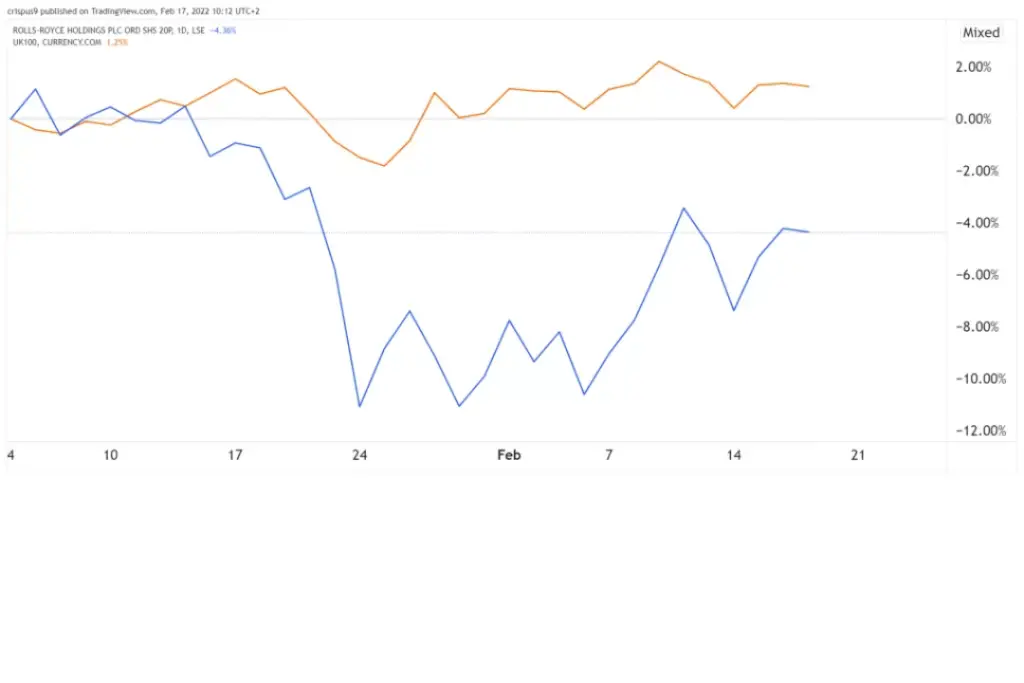

The past years have been a tough one for Rolls-Royce, with the pandemic hitting the company hard.

However, things are starting to improve as evidenced by the 15% increase in share price over the previous month. There are a variety of indicators that point to future share price growth.

Firstly, Rolls-Royce is working hard to pay its debts, and this is likely to improve investor confidence. Secondly, the company’s power systems and defense businesses have seen strong growth over the past 12 months, and this is expected to continue.

Finally, Rolls-Royce’s civil aviation business is also starting to recover from the pandemic, which should help to boost the share price further. Hence, there are solid grounds for anticipating continued share price growth for Rolls-Royce.

Does Rolls-Royce Have A Future?

Rolls-Royce is a name that evokes images of luxury and opulence. For more than a century, the British automaker has been synonymous with quality and perfection. Today, Rolls-Royce is facing some serious challenges.

The global recession has led to a dramatic decline in sales of luxury goods, and Rolls-Royce has been hit hard. In addition, other premium brands like Bentley and Jaguar are posing a greater threat to the business. Despite these challenges, Rolls-Royce remains confident in its future.

The business plans to increase its global presence while making significant investments in new technology. With its strong heritage and commitment to excellence, Rolls-Royce is poised to remain a leader in the luxury automotive market for years to come.

Also take a look at:

- SOS Stock Price Prediction – Should You Buy SOS?

- Square Stock Price Prediction 2023 – 2026

- Lucid Motors Stock Prediction – Is It A Good Investment?

FAQs – Rolls Royce Stock Prediction

Q1: How Can I Buy Rolls Royce Shares In The USA?

A1: First, you’ll need to open a stock trading account with a broker that offers US trades. After that, you must confirm your payment information and fund your account. Once that’s all set up, you can place an order to buy Rolls Royce shares.

Q2: Is RYCEY The Same As RR?

A2: Rolls Royce trades under the symbol RR on London Stock Exchange while it trades on NASDAQ under the RYCEY ticker symbol.

Q3: Why Is Rolls-Royce Stock So Cheap?

A3: The current economic trends in the world like inflation and global political situations like the Russia-Ukraine conflict have affected this year’s stock prices immensely.

Conclusion

The Rolls Royce stock prediction is that the company’s value will continue to rise. This is based on a number of factors, including the increasing demand for luxury goods and services, as well as the company’s expanding market share.

In addition, Rolls Royce has announced plans to invest in new technologies that will improve its products and increase efficiency. The only potential downside to investing in Rolls Royce stock at this point is the possibility of an economic recession, which could cause a decline in luxury spending.

We have now come to the end of our stock prediction blog on Rolls Royce Stock Prediction. Have a look at our other stock forecast articles for various companies trading on NASDAQ. Thanks for reading!