It’s always fun to speculate about the future, and that’s exactly what we’re doing today with our Square stock price prediction for 2023-2026. We’ll take a look at some key factors that could impact SQ’s stock price and give our best estimate for where we see it headed in the next few years. So, if you’re curious about where Square is headed, keep reading!

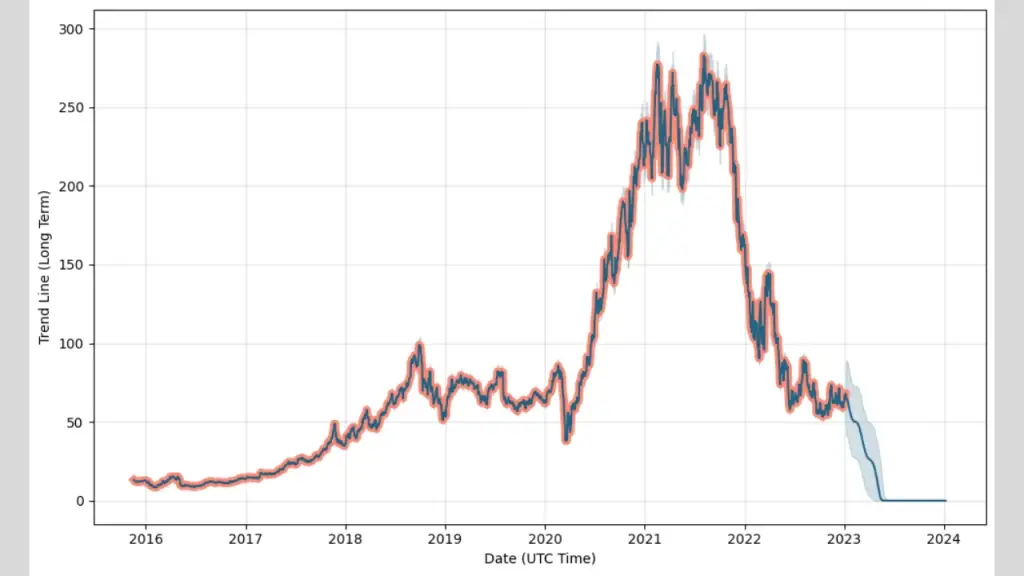

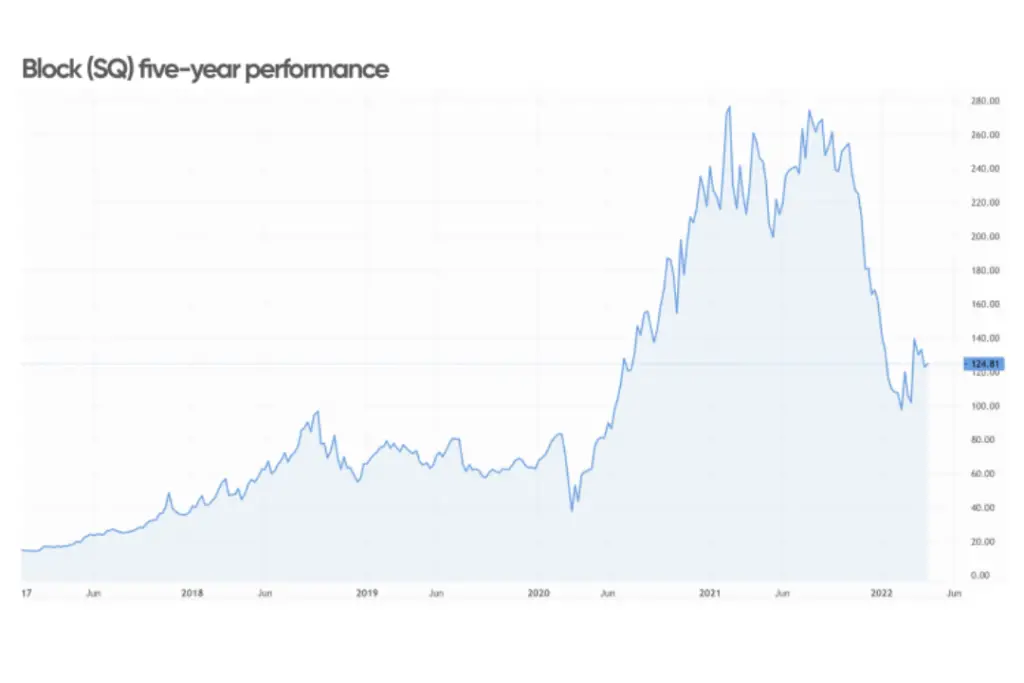

The current price of SQ stock is 71.65 USD. Although the stock price has shown a downtrend from the past year, it is expected to rise in the upcoming years as predicted by the analysts of SQ stock to be a Strong Buy. The price is expected to reach $96.66 in the year 2026.

Nevertheless, some predict that Square will experience positive growth in revenue and profit during this time period, while others believe that there may be some turbulence ahead.

Regardless of which camp you may fall into, it’s always important to do your own research before investing in any company. So read on to learn more about what analysts are predicting for Square stock, and decide for yourself whether or not it would be a wise investment.

Contents

Square Information And Performance

Square Inc. is a payments platform that makes it easy for businesses of all sizes to process payments anywhere, at any time. Founded in 2009 by Jack Dorsey and Jim McKelvey, the company uses innovative technology to provide an intuitive and user-friendly payment experience. The company has been trading on the NYSE since 2015 with a ticker symbol of SQ.

Whether you are a small artisan selling your handmade jewelry online or a large retailer processing payments in your brick-and-mortar store, Square has everything you need to accept payments quickly, easily, and securely.

With features like real-time reporting and robust fraud protection tools, Square helps businesses stay on top of their payments no matter where they are or what they’re selling.

Square has other businesses including, Cash App, Afterpay, Weebly, Tidal, etc.

Financial Data

| Market Cap | 42.852B |

| Enterprise Value | 39.61B |

| Revenue (ttm) | 16.96B |

| Shares Outstanding | 537.42M |

| Earnings Yield | -1.58% |

| EPS (ttm) | -0.17 |

| PE Ratio | N/A |

| Forward PE | 44.44 |

| Dividend | N/A |

| Ex-Dividend Date | N/A |

| Volume | 9,276,890 |

| Avg. Volume | 12,658,885 |

| 52-Week Range | 51.34 – 149.00 |

| Analysts | Buy |

Profitability

| Profit Margin | -2.97% |

| Operating Margin (ttm) | -2.20% |

Management Effectiveness

| Return on Assets (ttm) | -1.09% |

| Return on Equity (ttm) | -5.29% |

Cash Flow Statement

| Operating Cash Flow (ttm) | 324.89M |

| Levered Free Cash Flow (ttm) | -205.58M |

Square Stock Price Prediction For 2023, 2024, 2025, And 2026

Square Stock Price Prediction 2023

Analysts have predicted that SQ’s stock prices in 2023 are expected to be $51.00 with a low target of $45.54 and $56.81 at the highest target, expecting probable volatility of 19.840%. Negative tendencies are expected to prevail for this period.

Square Stock Price Prediction 2024

Analysts predict that the weighted average prices of SQ’s stock are expected to be $56.40 in 2024 with a low target of $53.90, and the highest possible target reaching up to $63.20. They also expect it to be volatile by 14.714%.

Square Stock Price Prediction 2025

In the year 2025, it is predicted that the weighted average price of SQ’s stock will reach $66.57 with a low target price of $60.34 and the highest possible amount up to $75.28. The expected price volatility is 19.843%.

Square Stock Price Prediction 2026

The weighted average stock prices are expected to reach $96.66 in 2026 with a low target of $84.34 and the highest possible range being $107.34. It will also be volatile by 21.432%.

What To Do with SQ Stock? Is It A Good Buy?

Investors in Square stock can expect to see significant profit and free cash flow (FCF) growth over the next year. Last quarter, FCF was negative but analysts believe that from here on out will be producing more positive numbers going forward.

There has been an increase in the usage of Cash App which is expected to raise the cash flow profits of the company. Looking at the predictions made by analysts, it is evident that they are expecting a bullish trend in SQ’s stock prices in the coming years.

Also, according to the 39 analysts’ reports, it is believed that these stocks are a good investment to hold in the long run with a consensus rating of Strong Buy with stock prices to rise almost by 70%. The market reports and predictions look optimistic toward Square stocks and have described it as “an awesome long-term (one year) investment”.

Also Check:

- Warner Bros Discovery Stock Price Prediction 2023 – 2026

- DiDi Stock Price Prediction – Share Price Forecast 2023-2026

- SOS Stock Price Prediction – Should You Buy SOS?

- Rivian Stock Price Prediction 2025 | What Do The Analysts Say?

FAQs – Square Stock Price Prediction

Q1: Is Square Stock A Good Buy?

A1: 28 Wall Street analysts have predicted that the SQ stock is going to rise and are optimistic about its future. They believe that it is a good investment due to their high expectations for profit margins and growth in revenue.

Q2:What Is SQ’s EPS Forecast For 2023-2024?

A3: SQ’s current EPS is -$0.91. Analysts have forecasted the EPS in 2023 to be $0.10 on average, and -$0.17 average for the year 2024.

Q3:What Is SQ’s ROA (Return On Assets) Forecast For 2023-2025?

A4: SQ’s ROA (Return on Assets) forecast is -0.64% for 2023-2025.

Q4: Why Square Stock Is Dropping?

A5: Due to the reduction in the use of cryptocurrency Bitcoin on the Cash App, SQ’s stock prices have dropped.

Conclusion

While there are many uncertainties that come with making a stock price prediction, we believe that Square will continue to grow in the next five years. We anticipate that their innovative products and services will keep them ahead of the curve, and their customer service will only improve.

Their innovative products and strong customer service will help them maintain their current stock price and even see an increase by 2026. With all this potential, our target price for Square is $194.17 per share by 2026.

What do you think? Do you agree or disagree with our analysis? Will Square be a major player in the payments industry five years from now? Let us know in the comments below.