The Warner Bros. company has been around since the early years of Hollywood, and today is one of the leading film studios in the world. What, though, does the future hold for this renowned studio? In this blog post, we’ll take a look at Warner Bros Discovery stock price Prediction for where it could be headed in the future. So stay tuned!

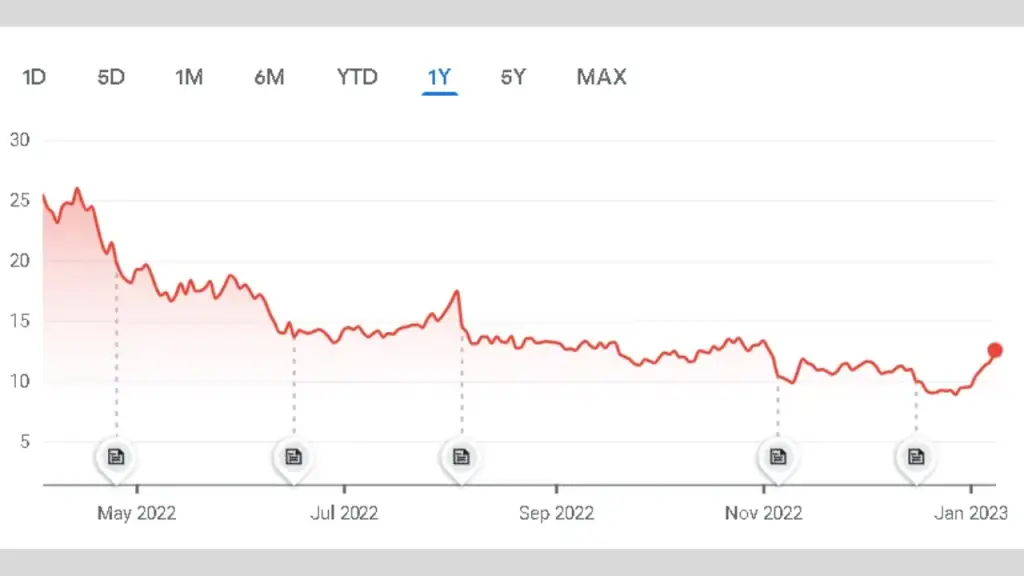

The current stock price of Warner Bros Discovery is 13.14 USD. Warner Bros Discovery Inc stock prices are expected to trend upward. The forecasted ROE (Return on Equity) for Warner Bros Discovery is expected to be 9.97% in 2025. The adjusted EBITDA is expected at $15+ billion and $10+ billion of FCF. The expected stock price per share is $27.216 at the minimum level and $27.611 at the maximum level.

All told, with its solid reputation, established brand name, and strong track record of success, it seems likely that Warner Brothers stock has even more room to climb. Let’s see why.

Recent Media Attention:

- Combined HBO Max and Discovery+ to launch in 2023 as Warner Bros. Discovery rejects AT&T strategy

- HBO Max is merging with Discovery+, and not everyone is happy about that

- Warner Bros. axes $90-million ‘Batgirl’ movie. Directors ‘saddened and shocked’

- Warner Bros Discovery lays off nearly 14% of its workforce at HBO, HBO Max

- Warner Bros Discovery Starts 30% Trim Of Ad-Sales Ranks As Pursuit Of $3B In Post-Merger Cost Savings Continues

Contents

Warner Bros Discovery – Company Description

Warner Bros Discovery is a leading media company that specializes in digital entertainment, content production, and distribution. With its roots in the entertainment industry, Warner Bros Discovery has become one of the most trusted brands among content creators and consumers alike having its content distributed in 50 languages.

Harry, Albert, Sam, and Jack Warner formed Warner Bros. in 1923. The company is based in Midtown Manhattan, New York City. On April 8, 2022, Warner Bros. and Discovery, Inc. amalgamated, and Warner Bros. Discovery was born. David M. Zaslav is its current President, Chief Executive Officer, and Director.

It owns a variety of television networks under the Discovery Channel, Food Network, TLC, HGTV, Animal Planet, Investigation Discovery, Destination America, Travel Channel, Science, MotorTrend, TVN, Discovery Kids, Eurosport, Discovery Family, American Heroes Channel, Discovery Life, Magnolia Network, Cooking Channel, ID, the Oprah Winfrey Network, Eurosport, and DMAX, as well as other regional television networks.

From cutting-edge technology solutions to unparalleled content quality, Warner Bros Discovery continues to set the bar for innovation in the rapidly changing world of media.

Whether you’re a consumer looking for your next favorite show or an aspiring filmmaker looking for creative opportunities and community support, Warner Bros Discovery has something for everyone.

Financial Performance

| Market Cap | 31.909B |

| Enterprise Value (EV) | 79.38B |

| Share Outstanding | 2.43B |

| Average Volume | 29,564,229 |

| 52-Week High | 31.55 |

| 52-Week Low | 8.82 |

| 200-Day Moving Average | 14.50 |

| PEG Ratio (5 yr expected) | 1.39 |

| EPS | 0.02 (-98.66%) |

| % of Float Shorted | 4.69% |

Profitability

| Profit Margin | -20.13% |

| Operating Margin (ttm) | -4.54% |

Cash Flow Statement

| Operating Cash Flow (ttm) | 2.34B |

| Levered Free Cash Flow (ttm) | 17.53B |

Warner Bros Discovery Stock Price Prediction For 2023, 2024, 2025, And 2026

Warner Bros Discovery Stock Price Prediction 2023

In the year 2023, 7 Wall Street analysts have predicted that the company would earn a revenue of $4,272,563,435, with -$606,898,215 on the lower end and $8,253,815,727 on the higher end. The share prices are expected to reach $23.40 in 2023 as predicted by analysts.

Warner Bros Discovery Stock Price Prediction 2024

In 2024, Warner Bros Discovery Stock price is expected to generate $4,466,770,864 in revenue/earnings, with the lowest earning forecast of $267,035,215 and $7,307,054,512 at the highest levels. The share price is expected to be $26.213 at the lower end and $26.653 at the higher end.

Warner Bros Discovery Stock Price Prediction 2025

The forecasted ROE (Return on Equity) for Warner Bros Discovery is expected to be 9.97% in 2025. The adjusted EBITDA is expected at $15+ billion and $10+ billion of FCF. The expected stock price per share is $27.216 at the minimum level and $27.611 at the maximum level.

Warner Bros Discovery Stock Price Prediction 2026

The stock prices in the year 2026 are expected to be at $28.226 at the minimum level and $28.642 at the maximum level. The opening and closing prices will be $28.537 and $28.642 respectively.

Is WBD A Good Stock to Buy?

Wall Street is calling for some moderate buying on WBD stock. Out of 16 analyst ratings, there are eight Buys and seven Holds with only one Sell in sight.

The price of Warner Bros. Discovery shares is expected to range between $15 and $44 dollars over short-term future prospects, with an upside potential of 92%.

In the streaming space, Warner Bros has a long way to catch up. It’s currently behind competitors like Disney+, but there are some things that it can take advantage of such as its movie library and reputation for quality films

Warner Bros might be seeing slower growth than other companies however over the next 10 years we could see them winning yet again.

Also Check:

- Dutch Bros Stock Price Prediction 2023 – 2026

- Rivian Stock Price Prediction 2025 | What Do The Analysts Say?

- Plug Power Stock Price Prediction 2023, 2024, 2025, 2030, 2040

FAQs – Warner Bros Discovery Stock Price Prediction

Q1: Is Warner Bros. Discovery Overpriced?

A1: Warner Bros. Discovery has been on a roll for the past 9 years, climbing higher in each of those periods and corresponding to an accuracy rate close to 56%.

Q2: Is Warner Bros.Discovery Stock Public?

A2: Yes, Warner Bros is a publicly traded company.

Q3: How To Buy Warner Bros.Discovery Stock Online?

A3: For investing in Warner Bros. Discovery shares, open an account at a top-tier brokerage firm, such as TD Ameritrade or Fidelity Investments.

Q4: Is WBD A Buy, Sell, Or Hold?

A4: Warner Bros has a consensus average rating of Buy based on 8 buy ratings, 6 hold recommendations, and 1 sell score.

Final Take

The Warner Bros. company is in a good place for the next several years, with expected growth and stability. The only potential obstacle to this success is if they mishandle any of their new franchises or make poor business decisions.

Based on all of these indicators, we predict that Warner Bros stock prices will remain stable and grow through 2026. The information in this blog on Warner Bros Discovery Stock Price Prediction can help you make informed decisions about investing in this company’s stock.

What do you think? Will Warner Bros. Discovery continue to grow and prosper in the years to come? Let us know in the comments below.