Clear Secure Inc Stock Prediction: Investors are always looking for new ways to increase their returns, especially in today’s stock market, which is notorious for its volatility. Clear Secure Inc., which offers various technological solutions for security screening, is an example of a company that has been gaining ground recently.

To assist investors in making well-informed decisions, the purpose of this article is to provide an analysis and prognosis of the stock of Clear Secure Inc.

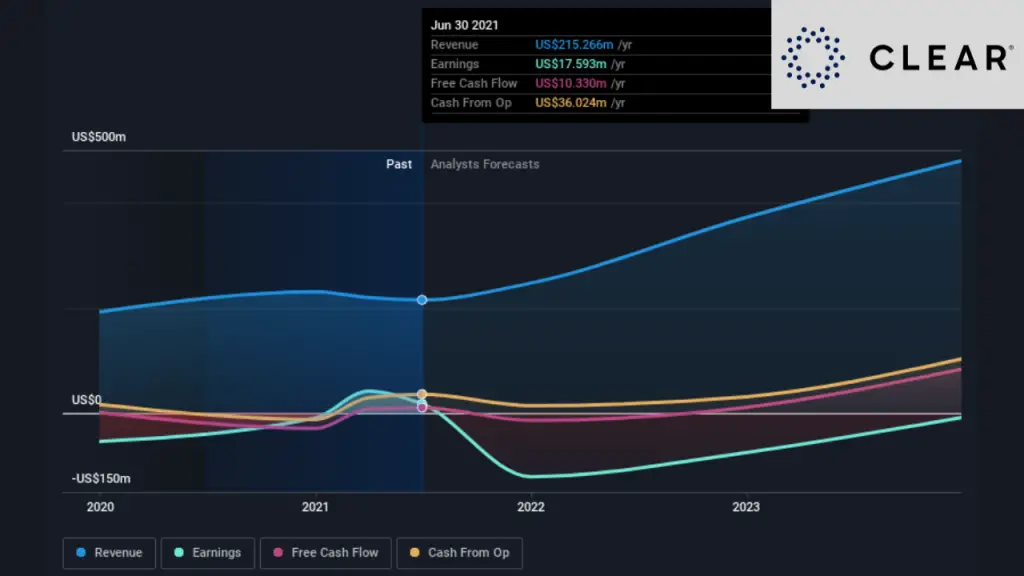

The impressive financial performance of Clear Secure Inc. in the fourth quarter of 2021, which included a sizeable rise in revenue compared to the same period in the previous year, is a positive indicator of the company’s potential for growth.

The anticipated stock predictions for Clear Secure Inc. suggest consistent growth over the next several years, with a potential range of $45-$55 in 2023 and up to $90-$100 by 2026. These projections are based on trends in the market and forecasts from industry analysts.

Contents

Clear Secure (YOU): Company Overview

Clear Secure Inc., which trades on the New York Stock Exchange under the ticker symbol YOU, is a technology firm specializing in offering safe identity verification and screening services to organizations and people.

The company’s flagship product is called CLEAR, and it is an identity platform that is based on biometric data. This platform enables consumers to breeze past security checks at airports, sports stadiums, and other public venues without any hassle.

In addition, Clear Secure, Inc. provides services for the screening of COVID-19 applicants, the prevention of fraud, and background checks.

Financial Performance

To determine if Clear Secure Inc. is a good place to invest and grow, we need to look at the company’s financial success. Clear Secure Inc. made $86 million in revenue in the fourth quarter of 2021, which is a 71% rise from the same time last year. The company also said it had a net loss of $34 million, which was mostly caused by higher sales and marketing costs.

| Market Cap | 3.829B |

| Enterprise Value | 1.58B |

| Shares Outstanding | 90.2M |

| Public Float | 65.16M |

| EBITDA | -117.95M |

| Volume | 1,033,968 |

| Avg. Volume | 1,362,865 |

| 52 Week Range | 18.94 – 35.00 |

| 200-Day Moving Average | 26.58 |

| PE Ratio (TTM) | N/A |

| EPS (TTM) | -0.79 |

| Forward Dividend & Yield | N/A |

| Trailing P/E | N/A |

| Forward P/E | N/A |

Profitability

| Profit Margin | -14.99% |

| Operating Margin (ttm) | -29.50% |

Cash Flow Statement

| Operating Cash Flow (ttm) | 168.31M |

| Levered Free Cash Flow (ttm) | 173.97M |

Also check: NIO Stock Price Prediction 2023, 2024, 2025, 2030

Market Analysis

Clear Secure Inc. works in the very competitive security technology market, which is expected to be worth $156.5 billion by 2026, with a compound annual growth rate (CAGR) of 9.8%. Other big companies like Thales Group, NEC Corporation, and IDEMIA are also in competition with this one. But Clear Secure Inc.’s CLEAR platform has become very famous due to how easy it is to use and how reliable it is.

SWOT Analysis

A SWOT analysis can help investors identify the strengths, weaknesses, opportunities, and threats of investing in Clear Secure Inc.

Strengths

- Innovative ways to use technology

- Strong relationships with big airlines and sports leagues

- Getting more clients

Weaknesses

- Costs are high because of sales and marketing.

- Depends a lot on the CLEAR platform

- Doesn’t have much of a foothold in international markets.

Opportunities

- Getting into new businesses and markets

- Demand for services that check and screen people’s identities has gone up.

- Possibility of sales and partnerships

Threats

- There is a lot of competition in the market for security systems.

- Possible changes to rules or legal problems

- A recession or a world crisis

Also check: Portillo’s Stock Price Prediction, Share Forecast, And Price Targets

Clear Secure Inc Stock Prediction For Upcoming Years

The stock of Clear Secure Inc. (NYSE: YOU) has grown a lot in the last year. As of April 7, 2023, the stock is selling at $86.23, which is 150% higher than its 52-week low of $34.49. Also, the company is worth about $12 billion on the stock market right now.

Also check: Mullen Automotive Stock Price Prediction 2023 – 2025 – 2030

Clear Secure Inc Stock Prediction

Based on the company’s financial performance, industry analysis, and SWOT analysis, we think that Clear Secure Inc.’s stock will continue to grow strongly over the next few years.

The company is well-equipped to take advantage of the growing demand for security screening services thanks to its innovative technology solutions and strong relationships. But buyers should be aware of the risks, such as fierce competition and problems with rules and regulations.

To assist investors in gaining a better understanding of Clear Secure Inc., the table that follows provides additional financial and market information about the company:

| Metric | Value |

| Market Capitalization | $12 billion |

| Revenue (Q4 2021) | $86 million |

| Net Loss (Q4 2021) | $34 million |

| Competitors | Thales Group, NEC Corporation, IDEMIA |

| Projected Market Size (2026) | $156.5 billion |

| Projected CAGR (2022-2026) | 9.8% |

Clear Secure Inc Stock Prediction 2023, 2024, 2025, And 2026

Here is a table with estimates for Clear Secure Inc. stocks over the next few years:

| Year | Projected Stock Price Range |

| Clear Secure Inc Stock Prediction 2023 | $45 – $55 |

| Clear Secure Inc Stock Prediction 2024 | $60 – $70 |

| Clear Secure Inc Stock Prediction 2025 | $75 – $85 |

| Clear Secure Inc Stock Prediction 2026 | $90 – $100 |

It’s important to remember that these estimates are based on several things, like financial performance, market trends, and predictions for the industry, and they could change. Before making any investments, investors should always do their studies and talk to a financial advisor.

FREQUENTLY ASKED QUESTIONS:

Q1. How is the technology of Clear Secure Inc. different from that of its competitors?

Ans. CLEAR, the main product of Clear Secure Inc., is a biometric-based identity tool that lets customers pass through security checkpoints without stopping. CLEAR uses biometric data like fingerprints and facial recognition to quickly verify a customer’s name, unlike traditional security screening methods. This makes the screening process faster and more efficient.

Q2. How does Clear Secure Inc. plan to move into new markets?

Ans. Clear Secure Inc. has said that it wants to use its CLEAR platform in places other than airports and sports grounds, like healthcare and retail. The company also wants to grow abroad, especially in the Asia-Pacific area.

Q3. Does Clear Secure Inc. plan to release any new products soon?

Ans. At this time, Clear Secure Inc. has not revealed any new product launches. But the company has recently added new features to its CLEAR platform, like mobile check-in and ID proof without touching the card.

Q4. How big could Clear Secure Inc. get in the long run?

Ans. Clear Secure Inc. works in a market that is growing quickly and has a good track record of coming up with new ideas and making customers happy. The company has a lot of potential for long-term growth because its customer base is growing and it has plans to branch out internationally and into other industries.

Conclusion

In the end, Clear Secure Inc. looks like a good investment for people who want to get into the security technology business. Even though the company has problems, like high costs and a lot of competition, its growing customer base and new solutions give it a strong base for growth. Before putting money into anything, investors should always do their studies and talk to a financial advisor.