Tesla Stock Prediction 2030: Tesla, the electric car manufacturer, has been one of the most talked-about companies in recent years, with its innovative products, cutting-edge technology, and ambitious growth plans. As Tesla continues to make strides in the automotive industry, many investors are curious about the future of its stock price.

With projections for the next decade and beyond, the question arises: How high will Tesla’s stock price go? In this article, we’ll examine some of the factors that could influence Tesla’s growth over the next decade and provide a forecast for the company’s stock price in 2030.

Tesla (TSLA) stocks are currently priced at 180.45 USD. Tesla was once doubted for its ability to make a profit but has recently proven its critics wrong by demonstrating strong financial performance.

With a net income margin of 10%, the company is expected to continue growing and increasing its profits as it expands its operations. As such, many experts have made optimistic predictions about the future of Tesla’s stock, highlighting the potential for continued growth and success in the years to come.

Contents

About Tesla, Inc. (TSLA)

Tesla is a global leader in the automotive and clean energy industry, with its headquarters located in the bustling city of Austin, Texas. In 2003, Martin Eberhard and Marc Tarpenning established the company and named it after the renowned inventor and electrical engineer, Nikola Tesla.

In 2004, the company received a massive boost when Elon Musk, through a $6.5 million investment, became its largest shareholder. Since then, Musk has been at the helm of Tesla as its CEO, leading the company to unparalleled heights in innovation and sustainability.

The company is known for designing and manufacturing electric vehicles, including cars and trucks, as well as battery energy storage solutions for homes and grid-scale applications, solar panels and solar roof tiles, and related products and services.

Tesla sold the most battery electric and plug-in electric cars globally in 2021, claiming 21% of the battery market and 14% of the plug market. Through its subsidiary Tesla Energy, which will have installed 3.99 gigawatt-hours of battery energy storage by 2021, the company also designs and installs photovoltaic systems. Tesla Energy is one of the biggest global suppliers of battery energy storage systems.

According to Musk, Tesla’s mission is to accelerate the transition to sustainable energy and transportation through the use of solar energy and electric cars. With a focus on innovation and technology, Tesla continues to lead the way in the development of clean energy solutions and the advancement of sustainable practices.

Financial Data And Performance

| Market Capital | 579.564B |

| Enterprise Value | 596.80B |

| Shares Outstanding | 3.16B |

| Float | 2.7B |

| EPS (TTM) | 3.77 |

| PE Ratio (TTM) | 47.86 |

| 52 Week Range | 101.81 – 384.29 |

| 200-Day Moving Average | 218.71 |

| Volume | 145,995,583 |

| Avg. Volume | 184,604,408 |

| Trailing P/E | 53.54 |

| Forward P/E | 50.51 |

| EBITDA | 17.44B |

Profitability

| Profit Margin | 15.41% |

| Operating Margin (ttm) | 16.81% |

Cash Flow Statement

| Operating Cash Flow (ttm) | 14.72B |

| Levered Free Cash Flow (ttm) | 4.21B |

Tesla Stock Prediction: Analysts’ Forecasts & Price Targets

Tesla Stock Prediction 2023

The current valuation of Tesla (TSLA) stocks is 180.45 USD. By the end of the year 2023, TSLA stocks are expected to reach as much as 214.55 USD. The minimum expected price target is 209.83 USD and the highest target expected is 226.35 USD. Positive dynamics will prevail in this period and the monthly expected price volatility would be 7.299%.

See also: C3.Ai Stock Price Prediction 2025, Price Targets & Analysts Predictions

Tesla Stock Prediction 2024

The weighted average price target for TSLA stocks at the end of 2024 will be 230.50 USD. The lowest expected price target is 217.57 USD and the highest target expected is 248.76 USD. Negative dynamics are expected to flourish in this period and the monthly expected price volatility would be 12.537%.

See also: UiPath Stock Price Prediction, “PATH” Share Predictions & Price Target

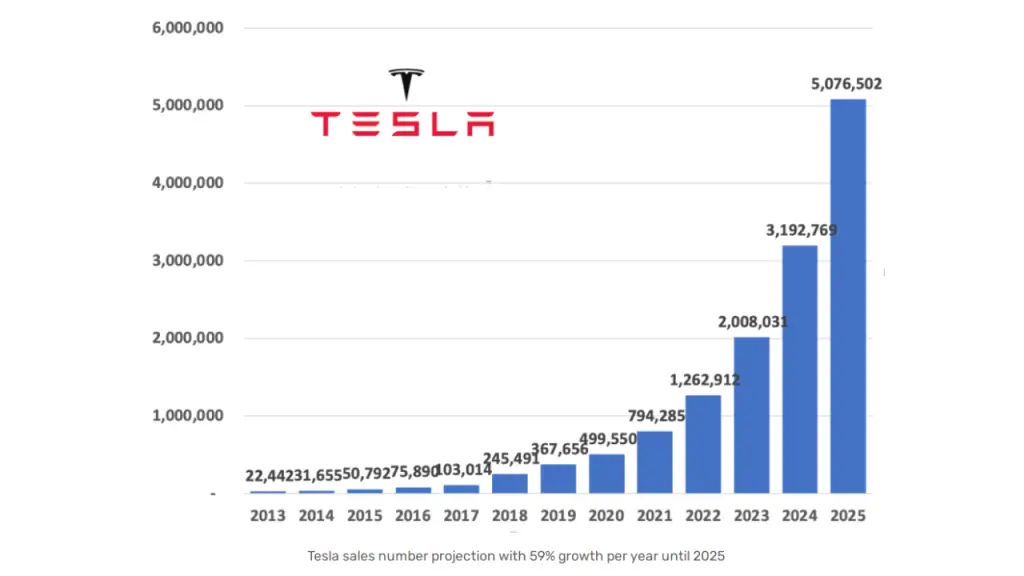

Tesla Stock Prediction 2025

By the end of the year 2025, analysts expect Tesla stocks to reach 298.83 USD. The lowest price target anticipated is 289.63 USD while the highest anticipated price target is 320.20 USD. Positive dynamics will prevail with monthly expected price volatility of 9.547%.

See also: Archer Aviation Stock Prediction, “ACHR” Share Price Targets

Tesla Stock Prediction 2026

The conclusion of the year 2026 will see Tesla stocks falling to 240.74 USD. The lowest expected price target will be 219.82 USD and the highest expected price target will be 251.60 USD. Negative dynamics will prevail for the period with monthly expected price volatility of 12.630%.

Tesla Stock Prediction 2030

Analysts are very optimistic about the growth and performance of Tesla in the upcoming years. The stocks have been expected to rise continuously in the coming years, with the prices rising to an all-time high of 1500 USD by the year 2030.

See also: Miso Robotics Stock Price Prediction: Is It A Good Investment In 2023?

How High Will Tesla (TSLA) Stocks Go?

In recent years, Tesla (TSLA) has been making waves in the electric vehicle market. Despite the pandemic’s chaos in 2020, Tesla managed to turn a profit, a feat that many other companies could not achieve. The company’s success is largely attributable to CEO Elon Musk, who succeeded Jeff Bezos in January 2021 as the wealthiest man in the world.

Tesla’s success is not limited to its financial performance; the company has also become a household name. Its electric vehicles are now considered the future of the automobile industry. This shift from traditional fuel-powered vehicles to electric cars has attracted investors from all corners of the globe.

Tesla is a publicly-traded company, which means that anyone can buy its stocks. As of now, Elon Musk owns 17% of the company, and there are approximately 1,937 institutional investors who own 41% of the company. Retail investors own about 42% of the company. The biggest Tesla shareholders are Blackrock, Vanguard, Capital Group, and Baillie Gifford.

Investors in Tesla are settling in for the long haul, thanks to the company’s consistent quarterly profits and growth. Tesla is now the largest manufacturer of luxury electric vehicles. Its name has become synonymous with the electric vehicle market, and the company’s shareholders are poised to reap enormous rewards if Tesla’s success continues.

So, how high will Tesla stocks go? It’s difficult to predict with certainty, but the company’s current trajectory suggests that its stocks will continue to rise. Tesla is a pioneer in the electric car industry, which is still in its infancy. As more consumers shift towards electric vehicles, Tesla’s market share will continue to grow, which will drive up the stock prices.

Moreover, Tesla is not just limited to the electric vehicle market. The company is also working on other ventures such as energy storage and solar panels, which have enormous potential.

The company’s recent acquisition of SolarCity is a testament to its commitment to clean energy and sustainability. Tesla’s growth prospects are enormous, and its shareholders are expected to enjoy a significant return on investment in the coming years.

Final Note

In conclusion, Tesla’s success is undeniable, and its future prospects are bright. The company’s innovative approach to the electric vehicle market and clean energy solutions has put it at the forefront of the industry. Its stocks are likely to continue to rise as the company grows, and investors are expected to reap substantial rewards in the coming years.

Thank you for following our Tesla Stock Prediction analysis. Do check back for more information on the financial market and forecasts for share prices.