Here we will look at some reasons why ChargePoint stock price prediction to increase and what this could mean for investors.

ChargePoint is well-positioned to capitalize on the growing demand for electric vehicles as a leading electric vehicle charging station company. While the company’s stock price has seen some volatility in recent months, analysts believe it will continue to rise in the years ahead.

The current stock price of ChargePoint is 10.03 USD per share. Analysts expect positive growth in its future performance. The average estimated stock price per share is expected to reach 12.79 USD by the end of the year 2025.

Contents

ChargePoint Holdings Information And Performance

ChargePoint is a company that manufactures and sells electric vehicle charging stations. The company was founded in 2007 by Richard Lowenthal, Dave Baxter, Harjinder Bhade, and Praveen Mandal and is headquartered in Campbell, California.

It has managed to make 34,900 charging stations in Mexico, Australia, Canada, and the United States. Pasquale Romano is the current CEO of ChargePoint Holdings.

ChargePoint’s products include charging stations for homes, offices, public spaces, and electric vehicles. The company has over 30,000 customers worldwide. ChargePoint is committed to supporting EV drivers and helping accelerate the transition to a clean, sustainable transportation system.

| Date | Number of Charging Spots |

| June 2017 | 35,900 |

| July 2018 | 47,000 |

| September 2018 | 53,000 |

| November 2018 | 57,000 |

| January 2019 | 58,000 |

| June 2019 | 65,000 |

| September 2019 | 100,000 |

| November 2019 | 103,700 |

| September 2020 | 114,000 |

| March 2022 | 174,000 |

ChargePoint’s stock price has been on the rise in recent years, and analysts predict that the trend will continue. Here we’ll take a closer look at ChargePoint’s stock price history and future prospects.

ChargePoint Financial Information

| Market Cap | 3.49B |

| Enterprise Value | 5.84B |

| Shares Out | 348M |

| Float | 297.32M |

| Revenue (TTM) | 468.09M |

| Volume | 6,329,584 |

| Average Volume | 9,324,960 |

| 52 Week High | 20.99 |

| 52 Week Low | 8.07 |

| 200-Day Moving Average | 12.86 |

| EPS (TTM) | -0.99 |

| P/E (TTM) | N/A |

| EBITDA (TTM) | -312.26M |

Profitability

| Profit Margin | -73.59% |

| Operating Margin (ttm) | -72.06% |

Cash Flow Statement

| Operating Cash Flow (ttm) | -267.05M |

| Levered Free Cash Flow (ttm) | -201.71M |

ChargePoint Stock Forecasts 2023, 2024, 2025, And 2026

ChargePoint Stock Price Prediction 2023

The beginning of the year 2023 will see positive dynamics prevailing. Stock prices are predicted to stay positive, with an average level of 9.24 USD per share. The average price at the end of the year would be 8.43 USD.

Negative trends are expected in this period. The lowest average target price will be around 7.48 USD and the highest target price to be 9.50 USD. The monthly possible volatility of 21.277% is expected.

Also check: LIC Stock Price Prediction 2023, 2024, 2025, 2026, And 2027

ChargePoint Stock Price Prediction 2024

The year 2024 will begin on good notes with negative dynamics prevailing. Stock prices are predicted to fall slightly, with an average level of 7.78 USD per share. The average price at the end of the year would rise a bit to 8.06 USD. Positive trends are expected in this period.

The lowest average target price will be around 7.31 USD and the highest target price to be 8.46 USD. The monthly possible volatility of 13.567% is expected.

Also check: BRCC – Black Rifle Coffee Stock Price Prediction 2023 – 2026

ChargePoint Stock Price Prediction 2025

The year 2025 will see positive dynamics prevailing. Stock prices are predicted to stay optimistic, with an average level of 8.50 USD per share. The average price at the end of the year will rise up to 12.79 USD per share.

Positive trends are expected in this period. The lowest average target price will be around 11.38 USD and the highest target price is 14.02 USD. The monthly possible volatility of 18.832% is expected.

Also check: GESI Stock Price Prediction 2023, 2024, 2025, 2026, 2027, 2028

ChargePoint Stock Price Prediction 2026

The year 2026 will see negative dynamics prevailing. Stock prices are predicted to stay pessimistic, with an average level of 12.65 USD per share. The average prices at the end of the year are expected to be 12.48 USD per share.

Negative trends are expected in this period. The lowest average target price will be around 11.48 USD and the highest target price is 13.86 USD. The monthly possible volatility of 17.147% is expected.

Also check: Meta Platforms Stock Price Prediction

ChargePoint Stock Price Prediction 2030

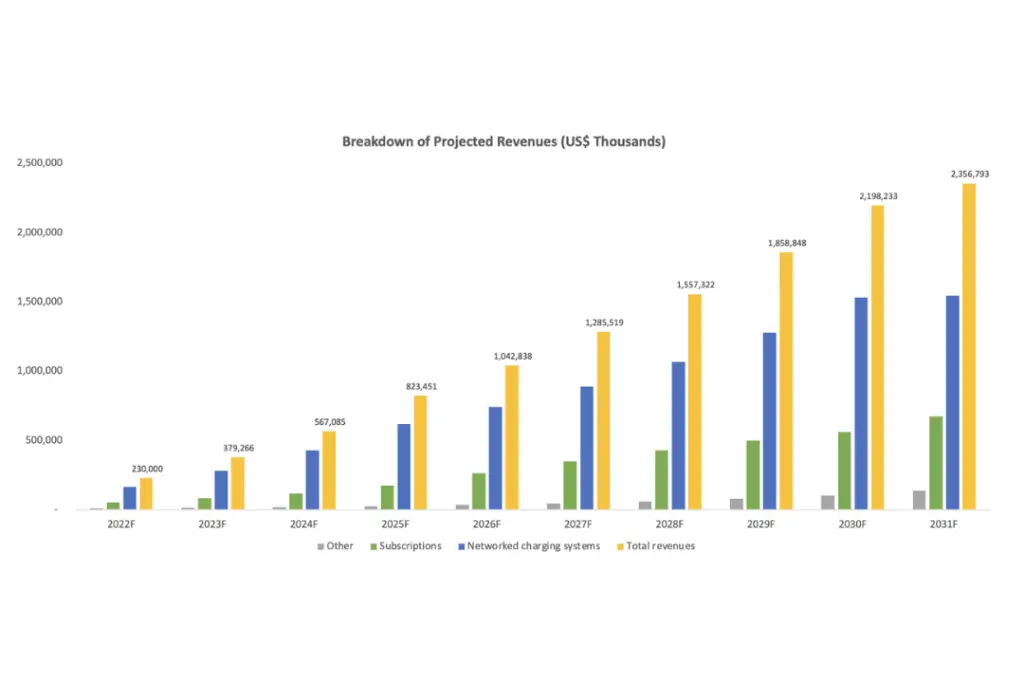

The federal government’s plans to increase the number of public EV chargers in America with a target number of 500,000 by 2030, is a huge opportunity for Chargepoint.

Chargepoint has one of the largest EV charging networks in the world, with 163,000 ports currently. In a decade from now, ChargePoint could continue to be the leading EV charging network.

The company is already profitable and expectedly plans on growing in the next years as well with their growth pans out how it’s predicted so far.

ChargePoint has been one of the more stable stocks in this industry, but it’s still not without risks. Investors should only invest long-term if they’re willing to take on significant amounts with high degrees of uncertainty because there is little information available about how Chargepoint will turn around.

Also check: UiPath Stock Price Prediction

Is Chargepoint Stock A Good Buy?

As per the forecast made by Wall Street analysts about Chargepoint stocks, 10 analysts have given it a rating of Strong Buy, and 3 analysts have given it a Hold rating.

The stock price of ChargePoint Holdings, Inc. has had a rocky history in recent years, with fluctuating valuations and constant speculation about the health of the company.

Despite some strong financial performance in recent quarters, there are still many investors who are skeptical about the future of the stock. CHPT stocks are recently experiencing some ups and downs in their stock prices making it difficult for analysts to come to a definite conclusion.

However, many analysts believe that ChargePoint’s recently unveiled electric vehicle charging network could be a game-changer for the company.

Not only will this network help to spur interest in EV ownership among consumers, but it will also foster strategic partnerships with other major players in the industry.

As more and more automakers begin to shift away from fossil fuels and embrace clean energy technologies, ChargePoint is well-positioned to capitalize on this growing trend.

And this rising demand for EVs is likely to boost demand for its charging stations and drive up its stock price in the months to come. So while some may think that ChargePoint stock is overvalued now, the long-term outlook looks bright indeed.

Also read our other stock prediction articles:

- Lucid Motors Stock Prediction – Is It A Good Investment?

- Warner Bros Discovery Stock Price Prediction 2023 – 2026

- Amazon Stock Price Prediction: Short And Long Term Forecasts

ChargePoint Stock Price Prediction – FAQs

Q1: Can Indian Investors Purchase Shares Of ChargePoint Holdings Inc?

A1: Yes, Indian Investors can invest in the ChargePoint Holdings Inc (CHPT) Share by opening an international trading account.

Q2: Can I buy Fractional shares of ChargePoint Holdings Inc?

A2: Yes. If you don’t have money to buy a full share, you can purchase fractional shares of ChargePoint Holdings Inc (CHPT) or any other US company shares.

Q3: What Are The Documents Required To Invest In ChargePoint Holdings Inc Stocks?

A3: The overall process to invest in Chargepoint shares is digital. You will require Aadhaar, PAN, Passport, Voter ID, etc. as identification and address proof for the same.

Conclusion

As the market for electric vehicles continues to grow, ChargePoint is well-positioned to capitalize on this trend. The company’s strong partnerships with automakers and its expansive network of charging stations will help it maintain its dominant position in the EV charging market.

The future of ChargePoint looks bright, and its stock price is only going to continue to increase. If you’re looking for a solid investment with great potential, ChargePoint is definitely worth considering. Thanks for following our analysis of this company!