Virgin Galactic Stock Prediction is one of the leading space companies in the world. With its history of innovation and its commitment to customer satisfaction, Virgin Galactic is sure to be a major player in the space industry for years to come.

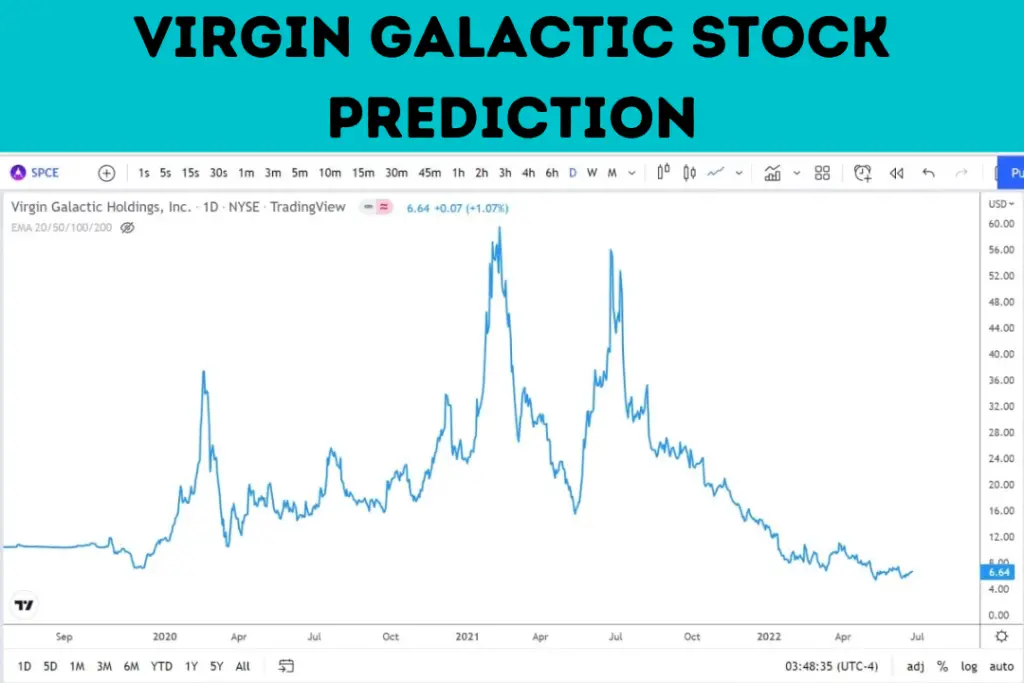

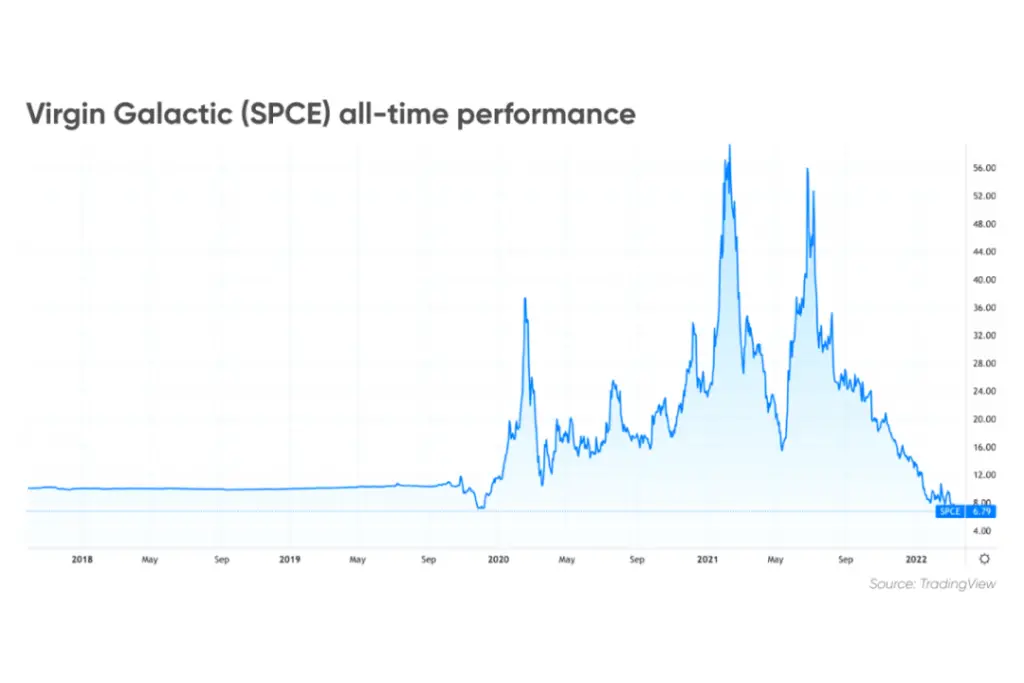

Its stock prices have been on the rise in recent months, and this looks set to continue into the future. Here’s a closer look at Virgin Galactic’s stock prices and what they could mean for investors.

The average estimated price target of Virgin Galactic Stock is expected to be $4.19 in 2025, showing a positive movement with 15.076% volatility. Analysts expect that the target prices will reach $5.73 in 2026.

Given the growing popularity of space tourism, there has been a lot of hype around Virgin Galactic and the company’s plans to launch commercial flights into space. Many investors are wondering whether this is a smart investment, and what their stock might be worth in the future.

Contents

About Virgin Galactic And Its Performance

Virgin Galactic is an American spaceflight company that was founded in 2004 by business magnate Richard Branson with the goal of developing commercial spacecraft capable of sending tourists into space. Its headquarters are in Mojave in California, USA, and it operates from New Mexico.

Their flagship product is the VSS Unity, a state-of-the-art spacecraft that utilizes innovative technology to transport passengers high above the earth’s surface and into the final frontier.

Since its inception, Virgin Galactic has made significant progress toward achieving this goal, with the company staging a series of successful test flights and creating a fleet of advanced spacecraft designed to carry human passengers.

Additionally, the company has partnered with a number of other organizations to develop innovative technologies, such as rocket boosters and launch sites, that are essential for taking commercial space travel to the next level.

In order to accomplish this goal, Virgin Galactic works tirelessly to design and build innovative spacecraft, leveraging cutting-edge technologies and industry best practices to create safe, reliable vehicles.

By pushing the boundaries of what is possible in space travel, Virgin Galactic continues to pave the way for a new era of exploration and discovery. Whether you are an aspiring astronaut or simply interested in seeing our planet from a new perspective, Virgin Galactic offers a unique and exciting way to experience space.

SPCE Virgin Galactic Price Statistics

| SPCE current price | $5.59 |

| Market cap | 1.535B |

| Enterprise Value | 839.41M |

| Shares Outstanding | 274.56M |

| Public Float | 222.97M |

| Volume | 19,942,598 |

| Average Volume | 6,498,828 |

| Earnings per share (EPS) | -1.25 |

| EBITDA | -414.6M |

| 52-week high | 11.25 |

| 52 Week Low | 3.24 |

| 50-Day Moving Average | 4.54 |

| 200 Day Moving Average | 6.06 |

| Annualized Dividend | N/A |

| Ex-Dividend Date | N/A |

| Dividend Pay Date | N/A |

| Current Yield | N/A |

Virgin Galactic Stock Forecasts For 2023, 2024, 2025, And 2026

Virgin Galactic Stock Prediction 2023

Analysts have predicted that SPCE stock prices at the end of 2023 are expected to be $4.23 with a low target of $4.00 and $4.44 at the highest target, expecting probable volatility of 9.867%. Negative tendencies are expected to prevail for this period.

Virgin Galactic Stock Prediction 2024

With a low aim of $3.40 and a high target of $3.91, analysts expect the price of SPCE stock will be $3.77 at the end of 2024, with potential volatility of 12.946%. For the time being, negative tendencies are anticipated to rule.

Virgin Galactic Stock Prediction 2025

The price of SPCE stock, according to analyst estimates, is forecast to be $4.19 at the end of 2025, with a low target of $3.69 and a high target of $4.34, and a likely volatility of 15.076%. It is anticipated that during this time, positive tendencies would rule.

Virgin Galactic Stock Prediction 2026

According to analyst forecasts, the price of SPCE stock at the end of 2026 is expected to be $5.73, with a low target of $5.51 and a high target of $6.27, and a likely volatility of 12.263%. For this timeframe, it is anticipated that negative tendencies would rule.

Are Virgin Galactic Stocks Profitable To Invest In?

Virgin Galactic has had another setback in its attempts at taking private citizens into space as announced by it recently. Additionally, the company’s Q2 earnings detailed report took longer than it should have.

The company earned just $3.4 million over the past year from commercial flights while burning $280 million in cash during that period.

To remain competitive in today’s market, the company took out a $425 million convertible loan earlier this year which has buffered them from some of their financial worries for now. They also had over 1 billion dollars worth of cash and equivalents as of June’s second-quarter earnings call.

However, some are still optimistic about its growth prospects and are hopeful that the conditions will get better for Virgin Galatic.

The idea of commercial space travel is becoming easier to imagine with each passing day. Now that Virgin Galactic has taken the first step, it’s not surprising that investors want in on this new industry- especially if they know how much money can be made!

This exciting concept has inspired investors many times over already- even if they’re not quite sure what will happen once we get up there.

Also read:

- Mullen Automotive Stock Price Prediction 2023 – 2025 – 2030

- Rivian Stock Price Prediction 2025 | What Do The Analysts Say?

- Plug Power Stock Price Prediction 2023, 2024, 2025, 2030, 2040

FAQs – Virgin Galactic Stock Prediction

Q1: Is Virgin Galactic Stock A Buy, Sell, Or Hold?

A: Virgin Galactic stock has been given a consensus rating of a hold by investors. These are average ratings based on 7 buy ratings, 8 hold ratings, and 7 sell ratings.

Q2: What Are Analysts’ Forecasts For Virgin Galactic Stock?

A: The Virgin Galactic stocks have received a consensus rating of Hold for its stocks by Wall Street analysts.

Q3: Who Owns SPCE Shares?

A: The largest shareholder of SPCE shares is The Vanguard Group, Inc. with a 6.82% stake owning 17,641,779 shares, followed by BlackRock Fund Advisors and SSgA Funds Management, Inc. holding 14,910,214 and 11,930,792 shares respectively.

Q4: Is SPCE A Good Investment?

A: SPCE has a Value Score of F, which indicates it would be bad for investors seeking value. It currently holds the potential to underperform its market counterparts as there are concerns about its financial health and growth prospects in future years.

Conclusion

Overall, we believe that Virgin Galactic represents a good long-term investment opportunity and urge readers to consider investing in this company. There are of course risks associated with any investment, but I believe that the potential rewards make it worth considering adding SPCE to your portfolio.