Is Sofi stock a good investment for the next decade? Let’s take a look at the company’s performance over the past few years and try to predict its Sofi Stock Price Prediction for 2023 – 2030. Sofia was founded in 2011 as an online student loan provider and has since grown into one of the most innovative and largest fintech companies in the world.

The current stock price of SOFI is 5.79 USD. The stock prices will reach the range of $57 to $60 by 2030 as predicted by analysts. The company reported remarkable growth in all its metrics and there are numerous reasons to be bullish on the stock.

Management shared excellent insight during their earnings call with us on how they’ve been able not just grow but accelerate this rapid pace of expansion by focusing heavily on product design for mobile-first consumers who want ease from frictionless interactions wherever their lives take them

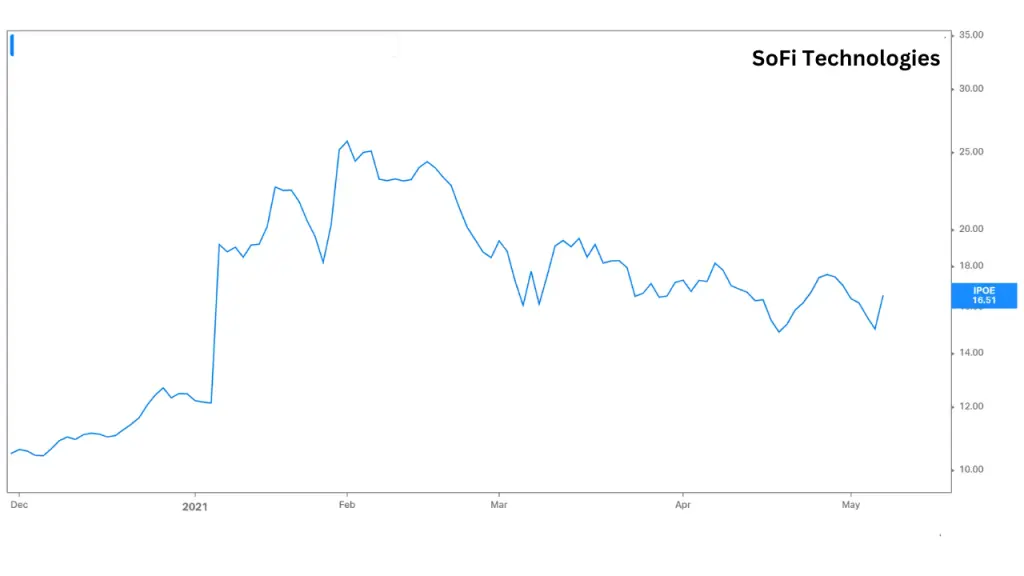

It’s safe to say that Sofi (SOFI) is a company on the rise. The online lender made headlines in late 2017 when it announced it had secured a $1 billion investment from Softbank.

That news, coupled with Sofi’s rapidly growing user base, sent the stock price soaring. While their stock price has been volatile over the past few months, I believe that Sofia is well-positioned for continued growth in the coming years. Here’s why…

Contents

SoFi Technologies, Inc.

SoFi Technologies (Social Finance) is an online personal finance company that offers a range of products and services to help consumers manage their finances more efficiently. It was started by 4 students, Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady in 2011 with its headquarters in San Francisco.

The first loan program test was at Stanford, where 40 alumni of the institution lent about $2 million to nearly 100 students, which was $20,000 per student on average.

The company’s online bank allows users to easily access online banking services and check their account balances, track spending, and make payments online.

Additionally, SoFi offers auto loan refinancing solutions to help customers save money on existing car loans, as well as home mortgages with low-interest rates.

Whether you are looking for practical advice on how to tackle your debts or simply need straightforward guidance on managing your money more effectively, SoFi has the expertise and resources you need.

With its proven track record of helping millions of people gain financial stability, this innovative online bank is committed to providing its customers with the tools they need to become financially organized and successful.

Social Finance – Financial Information

| Market Cap | 4.63B |

| Enterprise Value | N/A |

| Shares Outstanding | 799.63M |

| Float | 785.29M |

| Volume | 32,563,802 |

| Avg. Volume | 43,331,168 |

| 52 Week Range | 4.24 – 13.86 |

| Beta (5Y Monthly) | N/A |

| PE Ratio (TTM) | N/A |

| EPS (TTM) | -0.65 |

| Forward Dividend & Yield | N/A |

| Ex-Dividend Date | N/A |

| 1y Target Est | 7.33 |

Profitability

| Profit Margin | -28.81% |

| Operating Margin (ttm) | -27.17% |

Cash Flow Statement

| Operating Cash Flow (ttm) | -6.07B |

| Levered Free Cash Flow (ttm) | N/A |

Sofi Stock Price Prediction 2023, 2024, 2025, 2026, And 2030

Sofi Stock Price Prediction 2023

The company’s business model is strong and many Wall Street analysts believe that revenue has improved each year.

This means people are looking at Sofi stocks because they offer the bottom crust of what’s possible given its growth rate in profits, which will lead them up higher with time as more investors see value in investing now.

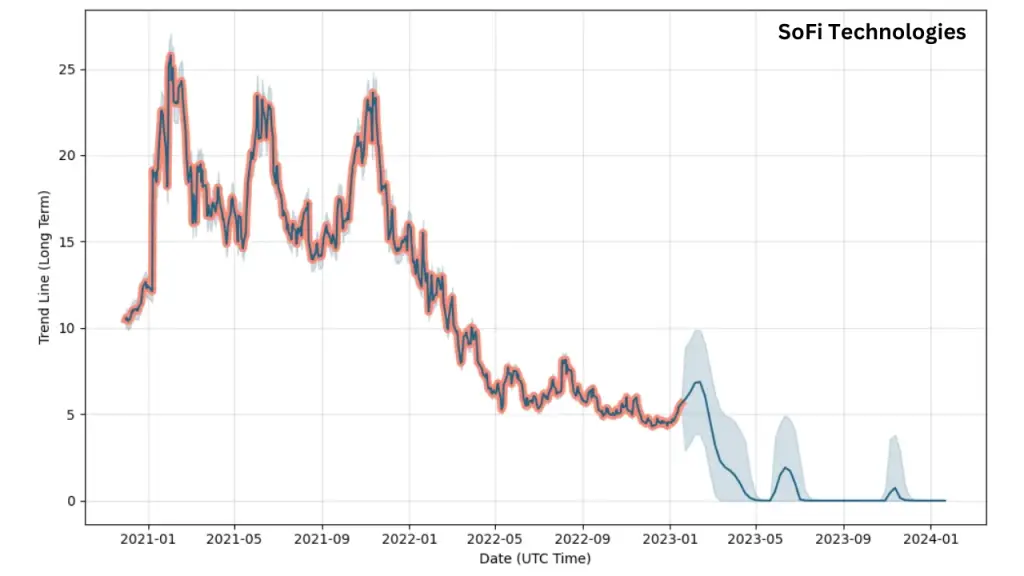

The price of Social Finance (SOFI) is predicted to reach $6.07 by the end of 2023, with an average level of 6.53 USD and a minimum value going as low as $5.73 per share.

Sofi Stock Price Prediction 2024

SOFI is expected to reach $6.33 by the end of 2024 with an average price of around 6.69 USD, going minimum to $6.02. However, it could be as low or higher than this depending on many factors such as the demand for services of Social Finance which will change over time too.

Sofi Stock Price Prediction 2025

SoFi has a unique vision to combine all of the consumer’s personal financial demands into one app. This positioning gives them an advantage in what could be trillions of worth opportunities because they are not just focusing on mortgages, but also credit cards and car loans as well.

As per the analysis and research based on our data, SOFI is expected to hit $7.48 by 2025, with an average price of $7.08 and a possible low of $8.03.

Sofi Stock Price Prediction 2026

Analysts predict Sofi stocks to be at an average weighted price target of 9.47 USD by the end of 2026. The lowest price estimate is to be 9.28 USD and the highest is to be 9.96 USD. The monthly expected price volatility is to be 6.755%.

Sofi Stock Price Prediction 2030

Based on our research, it is predicted that the price per SOFI share would reach $57 by 2030 end. The average expected price per share is $60 and reaching $55 on the minimum level.

Also Check:

- Warner Bros Discovery Stock Price Prediction 2023 – 2026

- Plug Power Stock Price Prediction 2023, 2024, 2025, 2030, 2040

- SOS Stock Price Prediction – Should You Buy SOS?

Conclusion

The Sofi stock price prediction for 2023-2030 is that the company will continue to grow and be a major player in the online finance industry. Sofi has already made a name for itself by being a leader in student loan refinancing, but they are looking to expand its services into other areas of personal finance.

With its diverse revenue streams and ability to expand despite multiple headwinds, such as the student loan moratorium SoFi is a buy for investors.

Their customer service is top-notch, which is why they have been able to maintain high levels of customer satisfaction and loyalty. All of these factors point to continued success for Sofi, so investors should consider adding them to their portfolios.